By Andualem Sisay Gessesse – while the value of Ethiopian government’s incentives for investors have been increasing over the past years, on the contrary the export performance of the country has been declining, report shows.

One of the main objectives of the government to provide incentives for both local and foreign companies is to boost export earnings of the country. Meanwhile the annual total export earning of Ethiopia has declined to $2.857 billion in 2015/16 from $3.152 billion in 2011/12, according to the date from the Ministry of Trade and Industry of Ethiopia.

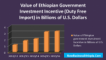

On the contrary the financial value of duty free incentives Ethiopian government has provided to investors has increased to $3.261 billion in 2015/16 from $1.116 billion in 2011/12, according to the date from Ethiopian Customs and Revenue Authority.

“There could be many reasons for the failure of Ethiopia’s incentives to boost its foreign currency earrings. But in general these figures tell us that the incentives have been misused,” says Melaku Kinfegebriel, Business Consultant at Noble Consulting.

“Either those engaged in the manufacturing sector and got those incentives are not exporting as they promised. They could be focusing in the local market. Or even if they are exporting they are maybe engaged in under-invoicing and contraband border trading, which reduce the amount of foreign currency coming to Ethiopia. Or the companies didn’t go operational at all, which means some were fake established only targeting the incentives. In my opinion, the reasons could be the sum of all these and other factors,” he says.

Last Ethiopian calendar which is concluded July 7, 2018, Ethiopia’s government plan was to generate $5.23 billion. Meanwhile the country exported only $2.84 billion worth products. Out of the annual planned earnings, the country’s aim was to generate $998 million from manufactured goods export.

But the achievement for the year (2017/18) was only secured $458.65 million (45%). Some of the major export manufactured goods of Ethiopia includes, textiles, shoes and leather products and medicines.

Investors engaged or plan to be engaged in the manufacturing sector in Ethiopia have been enjoying incentives from the government. Those incentives include tax free machineries and related capital goods import as well as exemption from export tax when they began producing locally and export. Among others, they have also been enjoying 70% now increased to 85% banks loan from state banks without collateral.

“Though there are benefits in terms of job creating from those who are genuinely investing using the incentives such as job creation, providing $3.7 billion duty free per within one year for an industry that generates less than 345 million is not acceptable by any standard,” Melaku says.

Around 80% of Ethiopia’s export commodities are still raw agricultural products and minerals. The raw products Ethiopia export ranges from tomatoes, fruits, garlic, milk, tea and coffee to live animals, equilaptus, wax and oil seeds, as well as several types of cereals and spices. The country has also been exporting raw minerals such as tantalum, gemstones and emerald, among others.

Though power outage is still a problem in the country including the capital Addis Ababa, Electricity is also the new export generating product of Ethiopia. Gas, which the country started production at small scale in Ogaden area Eastern part of Ethiopia in of Somali region is also expected to generate additional hard currency for the country.

Of the total $2.84 billion the country earned from export in 2017/18 fiscal year, 238,466 tons of coffee has generated $838.15 million.

The ministry of trade in its report stated that the decline of the price of coffee in the international market has reduced the income from coffee export. The report has also stated that the other reason for the decline of income from coffee export is because the regulators have failed to take punitive measures (beyond warning) against those who sell coffee for less than the global price.

During the same period, oil seeds, spices and Khat (addictive stimulant plant) have respectively generated $418.4 million, $268.12 million

Reports show that dependence on raw agricultural products, minerals and other primary goods export is making African countries vulnerable to global commodity price fluctuations. Experts’ advice these countries to focus on value addition to their raw commodities, which will enable the countries to create more jobs at home and increase their export revenues.

In addition, others also suggest for the need of a dedicated export promotion agency and a strong well integrated regulatory agency that helps to boost export performance of these countries based on research as well as deal with issue such as under-invoicing and following on fake investors engaged in money laundering and contraband trade, among others.