The government of Ethiopia reacted today to the European Commission list of third countries with weak antimoney laundering and terrorist financing regimes, which includes Ethiopia.

“…we urge the European Commission to consider removing Ethiopia from the list of high-risk third countries taking into account corrective measures that have been implemented; our proven commitment to combat terrorism and money laundering; and the limitations of the report in the first place,” said the Office of the Prime Minister Abiy in its statement issued today.

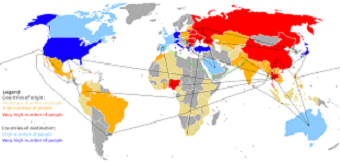

The list of third countries with weak antimoney laundering and terrorist financing regimes adopted on February 13, 2019, aims to protect the EU financial system by better preventing money laundering and terrorist financing risks.

The 23 countries listed by the Commission includes the war torn Libya, Yemen and Syria as well as Libya, Afghanistan, Botswana, Tunisia, Nigeria, Ghana, North Korea, Saudi Arabia, Iraq, Iran, Saudi Arabia, Sri Lanka, Bahamas, Samoa, American Samoa, Puerto Rico, Panama, Guam, Trinidad and Tobago and U.S. Virgin Islands.

The European Commission stated that as a result of the listing, banks and other entities covered by EU anti-money laundering rules will be required to apply increased checks (due diligence) on financial operations involving customers and financial institutions from these high-risk third countries to better identify any suspicious money flows.

Opposing its inclusion in the latest list the government of Ethiopia calls on the EU Commission to ‘urgently review the “high-risk third countries” listing.

“Ethiopia would like to challenge the report in its limitation to name jurisdictions that are directly and indirectly playing a role in fostering illegal trends by creating a safe haven for perpetrators. A good case in point is Africa’s annual loss in the billions due to corruption and money laundering. Most of this money does not stay within the continent; it is rather deposited in offshore accounts or illegally invested in properties all over the world,” Ethiopia government said in its statement.

“Locating and recovering these funds is near to impossible for most of us, making the fight against corruption and money laundering harder than ever,” it said, indicating the seriousness of European Commission report and its commitment to fighting against money laundering and terrorism financing on its home front.