By Andualem Sisay Gessesse – Following the recent liberalization of Ethiopia’s forex market for the first time, debates have been going on between those who support the government decision and those against it.

The bold decision by the government is indeed revolutionary and debatable. In this article, I will try to look at who are the most beneficiary and losers of the liberalization of forex market in Ethiopia.

The bankers

Let’s start with the voice of the losers for they are the one who are making the launder notice about it. In my view, the top losers are the managements of the banks. This is how. In Ethiopia, it has been a norm for an importer of goods or machineries to pay double the official price of exchange rate for those who allow one to open a letter of credit (LC) for import.

Because of the chronic shortage of hard currency in the country, it is impossible for an importer to get hard currency from these banks. The norm for the past few decades if for instance an importer needs $100,000 and the official exchange rate if $1 for Birr 58, he or pays 58 Birr officially and another 58 Birr as a kickback for those in the bank that facilitated the opening of the LC. In addition, the importer is also expected to pay another 10% service fees for the bank.

So, almost all importers in Ethiopia have been paying Birr 116 Birr plus 10% of it (Birr 11.60), which is equal to Birr 127.60 for a single US dollar. This was the practice and the fact on the ground.

Hence, liberalization of the forex market in Ethiopia is a nightmare for these corrupt bankers. They are the first to lose from the liberalization. If the country opens the market and allows forex buraus to flourish, these individuals are not going to rob the importers, which later top-up the price on the final consumer to compensate the hidden cost they encored.

Greedy importers and distributers

The corrupt bankers we saw above are the result of greedy importers of merchandizes, who are willing to pay any amount of kickbacks to the bankers because they know that they are going to the additional cost on the final consumer dump like hot potato. For the past few decades these importers have been robbing the public monopolizing the imports of major consumers goods.

Because a few greedy importers have been able to bribe the bakers and grabbed all the available hard currency, a few importers were in monopoly of importing cooking oil or rice or any major consumer good deciding the price.

Do you think they calculate the price with exchange rate of 58 Birr for $1. No! in fact, when one greedy importer secures $100,000 from the banks to open an LC, he or she collects another $100,000 or even more from the black market with almost same cost of over 120 Birr for a single US dollar. So, whatever they are importing, they are calculating as if they bought one UD dollar for Birr 127.60. Not Birr 58 + 10% (Birr 5.80), which in total becomes Birr 53.80. As a result, the price of a commodity they imported is determined based on the fact that one USD is equivalent to Birr 127.60.

And the worst part is that because the money these greedy importers injected into the import as a kick back will not be accounted as an expense for them, they are going to add this cost on the price of the commodity. In addition, let’s not forget that they will also add profit margin.

At the end of the day, the public which have no other choice because there is no competition among importers, will take the burden of paying extra – at times 200 times or 300 times for an imported commodity compared to its price in the neighboring countries.

So, these two major groups and their officiates are the one making the louder notices opposing the forex liberalization of Ethiopia over the past few weeks. The fact that they are trying to increase to the already imported and distributed commodities over the past few days shows how desperate these greedy importers and distributers are. In addition, the fact that the national bank of Ethiopia has banned 12 banks engaged in fraudulent activities and manipulation of forex after the market is liberalized also suggests how disappointed these bankers are.

Now let’s see to the two major beneficiaries of forex liberalization not immediately but sooner. Well it is obvious that those on the other side, which are the exporters and the general public or the end consumer will soon be the top beneficiaries of the forex liberalization.

Exporters and manufacturers

Let’s see first how an exporter including those who manufacture and ship their commodities abroad, will benefit from the forex liberalization. Before that let’s be on the same page with yet another custom or norm related to exporters in Ethiopia. In Ethiopia almost all the exporters are importers at the same time. Why? This is mainly because import business is where one makes huge profit in Ethiopia because of the forex crunch as we have seen above.

As a result, an exporter in Ethiopia doesn’t care much if he or she makes profit from export. Because he or she knows that the reason they export is to get a certain portion of the hard currency they generate, which was around 30% and use it for importing consumers goods that they can sell easily with a very lucrative profit margin.

Except for those commodities such as coffee, which prices are set in global commodity markets, most Ethiopian exported products have been under-valued and under-invoiced mainly because of the battle to get hard currency for import and to stash some of the hard currency abroad so that they will use it later for import. In the middle of this malpractice in the export sector, many genuine exporters of commodities and those in the manufacturing sector producing export items have fully moved to importing merchandizes ranging from electronics, kitchenware’s, to construction materials and all sorts of consumer goods.

So, don’t get surprised if a leather products factor, which was exporting worth tens of millions of merchandizes has now turned to importing refrigerators and machineries. Such forced business shifts have killed tens of thousands of jobs in the manufacturing sector in Ethiopia from textless to pharmaceuticals to garment and furniture.

Liberalization of forex market in Ethiopia means a good news for genuine exporters, especially for the farmers unions and those who have commercial farms and deserve the right price for their commodities. Likewise it going to be the beginning of the revival of the manufacturing sector in Ethiopia, because having access to forex means having access to new technologies, machinery spare parts and perhaps concurring the neighboring markets using the Africa Continental Free Trade Area agreement by producing highly competitive products mainly in the leather, textiles, furniture, construction materials, among others.

Consumers general public, government

Ethiopia’s forex market liberalization is going to be like to be released from prison for the Ethiopian consumers, who suffered for decades by the greedy importers and distributors of consumers goods. Let’s see how this works out. First of all the real price of one US dollar against Ethiopia is birr was not the one, the banks used to list on their websites. The real price was double that amount as we have seen above. The prices for all imported items were in fact calculated based on this double that of the formal rate or equal the black market rate.

That means having access for hard currency for any Ethiopian or non-Ethiopian living in the country means, entering to those import business and bringing down the prices of these consumer goods down through competition. So, a consumer or a group of consumers can easily engage in import and distribution especially in relation to highly consumable goods. This by itself can create new jobs and incomes both for the practitioners and the government boosting its import taxes. Of course these benefits are in addition to the benefits for those who need hard currency for abroad treatment, education, business and leisure travelers and do online businesses and can generate hard currency without leaving Ethiopia.

Back to the black market issue, the funny thing is that is you ask a Chinese business person in Ethiopia to import for you a product or a machine worth $10,000 USD, he or she will convert the Birr with black market rate and tells you to pay in Birr the equivalent.

By the way next to the importers, the major collectors of hard currency in Ethiopia are the Chinese business people. For long time the Chinese tycoon owned Binance cryptocurrency platform have been a good place for buying hard currency with the black market rate using Ethiopian Birr and Ethiopian banks.

So, it was the Chinese businesses and the importer, who were the major consumers of hard currency in Ethiopia. Because of the shortage of hard currency in Ethiopia, the Chinese or any other foreign companies have not been able to collect their profits and repatriate it using the formal banking system. As a result, they all have been using the black market and they are the one who set the price of Ethiopian Birr against the US dollar or other major currencies. Of course the real estate companies from the United Arab Emoratas have also been collecting hard currencies in black market from Ethiopia when they sell their hotel apartments in Dubai for Ethiopians.

The government

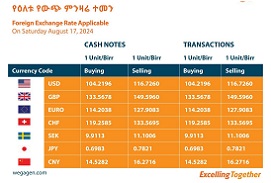

When we come back to how the government benefits from the liberalization of the forex market, the first thing is through windfall tax. Following the liberalization of the forex market, today the official exchange rate to sell $1 has increased from Birr 58 to 116 in most banks.

The next morning following the liberalization news, the Ethiopian Birr is officially devaluated by 31%. That means the value of the money found within Ethiopian banks have increased by 31%. This is a windfall profit for the banks. As it has done about a decade ago, the Government of Ethiopia is likely to collect huge amount of taxes from these banks.

But most of all, the income mainly the import tax income of Ethiopian Government is likely to increase from 50 to 100 percent as a result of the forex market liberalization. This is mainly because now the importers are going to show the actual commodity price invoice, which is going to be double in Birr in most cases. That could lead the the reduction of under-invoicing by the importers.

So, if Mr. X have imported goods worth Birr 100 million , he or she is likely to pay 30% of it as import tax, which will be double the amount had the exchange rate remain where it was before liberalization of the forex market. In addition improved manufacturing sector and export performances will also benefit the government in terms of tax and export income in the long run.