In Summary – In 2007 Ethiopia introduced biofuel development strategy. Not long after, the non-oil producing country began promoting the availability of close to 24 million of hectares of land for global investors who are interested to plant castor beans and jantropha and produce biofuel.

To the contrary, after over a decade of Ethiopian government promotion of investment in biofuel development and dozens of companies invested in the sector, none of them have been able to produce a single liter of biofuel to this date.

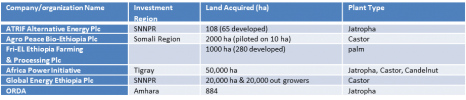

In 2013 there were 25 biofuel investment projects in Ethiopia. This is nine other companies engaged to produce ethanol from sugar factories. All together the projects of these companies cover half a million hectares.

The companies engaged in biofuel development includes from the United Kingdom, Germany, United States, Israel, India and local, among others.

This includes: Flora Eco Power (a joint venture of Germany and Israeli investors), which had a 5 year plan with an annual production of 700,000 ton of oil by 2011, which left the country after clearing elephant sanctuary in eastern part of the country.

Anduaem Sisay Gessesse, the former reporter of Capital newspaper, who used to report on the coming of these biofuel companies at that time, now revisits the status of these investments.

He writes his this opinion piece on how possibly all of these companies have failed to produce a single liter of biofuel and left the country after damaging the environment and benefiting from generous government incentives.

………………………………….

Government assumption

We all make assumption at one point on different issues and have expectations based on the information we are exposed to. That is why I subtitled this section ‘government assumption’. It was after the mid 2007 that investors from different countries began flocking to Ethiopia with biofuel development investment projects.

This is following Ethiopian government promotion of its biofuel development strategy. The government began inviting these investors to produce biofuel in the country from plats such as, jatropha and castor bean.

As a rookie reporter at the time, who is fascinated with the idea of producing fuel from plants, I begun reporting almost every other week. Based on the registration data from the federal investment registry, my reports were more focused on what these companies are hoping to produce and on what size of land, etc.

From Global Energy of the United States, which had a plan to produce around 300,000 liters of biofuel per day, to many Indian, German, Israel, British and local companies, I reported several of these investment projects.

At the same time my colleague who used to work for the other English weekly also has reported about many of these investment plans.

In fact I remember some of our friends teething us saying, “You guys have already finished the land of the country allocating to biofuel investors and commercial farms. What are you now up to? Borrow land from the neighboring Sudan?”

It was also on one of those days that my editor wrote an interesting piece entitled, ‘The Biofuel Samba in Ethiopia’, questioning the genuineness and feasibility of those investments.

It was about a year ago that I decided to revisit the status of these investments and began collecting all the relevant information from different sources. When I found out that all of these companies have failed, my first inclination was to do an investigative story that might win me a global award.

But I realized that I can’t do that, especially after the two state banks recently failed to give me the sector specific loan data even though I waited for a month. So I decided to write this opinion piece based on official facts, which I managed to access with assumptions of mine and the government. Before moving to my opinion

I just wanted to inform my readers a few things. The first one is that it is indeed possible to produce biofuel from jantropha, castor bean and similar plants in other parts of the world such as Brazil, the United States and European countries.

In fact in 2010, biofuels provided 2.7% of all global fuel for road transportation. The supply is dominated by bioethanol, which accounted for approximately 82% of total biofuels production in 2010.

In fact in 2010, biofuels provided 2.7% of all global fuel for road transportation. The supply is dominated by bioethanol, which accounted for approximately 82% of total biofuels production in 2010.

The second issue I want my readers to know is when I say biofuel investments in Ethiopia; it doesn’t include ethanol production from sugar factories. Even though there are some interesting thongs to look into in relation to investments on sugar and ethanol production, I decided to write about it in the future.

By the way, biodiesel can be produced from any oily plant I am focusing on. On the other hand, bioethanol can be produced from any plant, which has high sugar concentration, including corn, sweet sorghum, cassava and sugarcane.

So this article focuses on investments registered in Ethiopia to produce biodiesel from plants such as jantropha, castor bean and palm and the like.

I produced this article with a hope that those government institutions, who didn’t give their data for me, might share those data to other institutions such as, a different media, customs investigators, and investigators of anti-corruption or the National Bank of Ethiopia that is in charge of supervising all financial transactions in Ethiopia.

Dear reader I hope you will enjoy the article. And with all due respect please don’t jump to the conclusion that I am writing this to paint a negative image to the country, involved government institutions or the investors. I am saying this because I have come across many Kebele-cadre mindset people who usually rush to label us as neo-xyz, instead of dealing with the reality and finding solution.

So I am rather doing this to tip relevant government investigators to probe into these ‘doggy’ investments and the people involved from government offices as well as those international brokers and lobbyists – state captures who push for the introduction of policies that benefit them.

The companies’ promises and government expectation

After revealing its Biofuel Development Strategy in 2007, the reason Ethiopia began calling on global investors to engage in biofuel development was to get an alternative energy source and cut its growing fuel import bill.

The assumption was to use its around 24 million hectares of land for planting jantropha, castor bean and the like convert these plants to biofuel like Brazil. The land is said is not suitable for other crop production though later reports tell different story.

For Ethiopia, which is net importer of petroleum and its byproducts, finding an alternative energy source is indeed critical, especially in the face of depleting hard currency reserve.

Carrying this growing burden in the face of the vicious hard currency shortage the country has been experiencing for the past decades is not east at all. For the country which earns less than $3 billion from export of goods while spending $17 billion on import, it is not questionable to reduce this burden that is consuming more than half of its all export income.

In addition introduction of biofuel is also expected to:

- Enhance agricultural development and agro processing; job creation and improve income of the people

- Improve agricultural land productivity through integrations of biofuel development program with land use plan

- Decrease environmental pollution through the promotion of biofuel utilization

Attracted by the incentives?

Out of about two dozens of biofuel investment projects registered and began operation since 2006, not a single liter of biofuel is produced by any of them.

These investors didn’t come to venture in biofuel development just because Ethiopia is suffering from the growing fuel cost and increasing consumption. That is an opportunity for the m to invest.

These companies came to invest in the sector because Ethiopian government has given them the most attractive incentives, which they don’t find in any African country at that time.

The first attractive incentive is getting 70% of the total investment cost of a project from the state bank without any collateral.

The second one is tax free import of all capital goods (machines) and inputs. The rest of the incentives include export tax exemption as well as profit repatriation, among others.

The reporter’s assumption

Let’s just focus and see how the first two incentives could likely be abused by some or all of the companies who came to invest on biofuel development many using public money.

The reason I am now moving from facts and figures to assumption is because both the state banks, which were and are in charge of financing such projects have declined to make public sector specific – loans they provided in the last ten years as requested by the writer of this article.

And these assumptions are actually based on the investigations made in other countries and companies, which are engaged in doggy businesses.

OK, let’s comeback to our assumption and say that Company X has come up with biofuel investment project, which needs total investment of $30 million to be implemented in three phases. As per the investment law of Ethiopia if that company is planning to operate 100% as foreign company, it is required to transfer and show not more than $200,000 into Ethiopian bank.

So company X has transferred $200,000 after getting assurance from a government office that it will secure the land of its choice after the transfer of the money.

Investing company money VS government money

Now all Company X is going to do is rent office, recruit some employees to activate the business while at the same time processing the 70% loan from a government bank. Because the company is already promised by the government officials, who have been trying to convince ‘these investors’ to take advantage of this attractive opportunity in Ethiopia knowing they are doggy investors or or not.

After all who needs to risk his/her own money in an unproven business while there is government money to play with?

Then let’s assume that company X will secure between $10 to $27 million loans depending for which phase of the project the loan is requested. To make our assumption simple let’s say that Company X secured $10 million loan from one of the two state banks and ordered machineries after presenting three different invoices of suppliers.

Most likely from tax heaven jurisdictions such as, Dubai and China, which are major sources of under-invoicing, according to the latest data of Ethiopian Customs and Revenue Authority.

This is exactly the point where a doggy company makes money. If Company X is sure that there is no way to continue the biofuel investment in Ethiopia and make profit from production in the future, what it will do is to design how to make money out of this purchase. So Company X has decided to exaggerate and double the invoice prices of the machineries it is buying and importing.

Therefore for worth $5 million machineries, Company X has provided invoices of $10 million claiming that the company is buying Italian or German machineries, which are often considered expensive and durable compared to the Chinese.

After all who questions or cares where the heck the machines are coming from and crosscheck on arrival when the machines arrive. The company can even receive used machineries not more than one million dollar or empty container it chooses to take away all the money. This is the kind of tricks money laundering, shell and shelf companies in the world having doing, according to the recent revelations of Panama Papers and Paradise Papers.

Making profit before commencing production

Under the current working procedures Ethiopian Investment Commission is the one who writes support letter or give permission for investors to import duty free capital goods or inputs.

But the Ethiopian Customs and Revenue Authority of the country with its nine entry points across the nation is the government agency that allows these duty free imported items into the country.

Meanwhile up until today the Authority do not have a reporting back and forth mechanism to the Investment Commission whether Company X has used its duty free privileges one time or ten times and what kind of items it has imported.

So, Company X has already made $5 million profit before starting the actual business. If lucky the doggy company can repeat this trick three times or even more because there is no reading between the different government agencies and investigate what Company X is actually doing behind the curtain.

All the company has to do is give excuses to the investment support department personnel, which allows the company to delay and complicate biofuel investment. Finally when it is time for the company to leave the country, Company X will probably make its employees to move into elephant sanctuary or cut indigenous trees going beyond its investment area.

The opposition from the community will be perfect excuse and green light for Company X to pack and leave the country. It may probably move to another victim Uganda or Tanzania, who knows?

Now what is left for the state banks who lend the public money to this company? Since there was no collateral in the first place, the banks will probably be left with those inflated (over-invoiced) machineries.

Too much assumption? Sorry…It is just a sign of dying journalism in a secretive environment where accessing official data is tough or almost impossible at least for me. After all as I said above, this is not my investigative piece, it is a tip to help government investigators probe into this neglected but serious case. It can also be a good lesson for the regulators to look into investments in every sector.

They regulators can start with a simple question, “Why is the foreign currency coming from export of X commodity/product is not growing or declining while the investment in that sector and the collateral-free loans and other tax incentives these investors are getting is increasing?

The Cost

Back to our topic let’s now see briefly the damages caused by these fake biofuel investments. The reason I said briefly is that I didn’t go to the ground to talk to the affected community.

As a journalist I should have done that…but I can imagine that you also don’t want me to go there under the current situation, especially the state of emergency.

I rather leave the in-depth investigations to the government investigators, especially in relation to how much of the loans the companies took and payback as well as the monetary value of the tax exemption benefits used for nothing.

So what the costs I talk about below are only based on the reports and studies made other independent organizations and government organization. These reports focus more on the damages some of these companies caused on the environment and the community.

First let me tip you one of my reasons why I used the word doggy to describe these investments. Even though there is seed legislation in Ethiopia, some of these companies were importing hybrid seed from China without any regulation and distributed the seed to farmers as out-growers in Wolaita Zone and Arba Minch areas, according to Rezene Fessehaie who presented a paper at a regional workshop on ‘Bio-fuel Production and Invasive Species’ from April 20 – 22, 2009 in Nairobi, Kenya.

My assumption is that importing anything for a company under-such poorly regulated business atmosphere is the best means of taking out capital in hard currency legally.

You may think that this could not be the case for these biofuel companies.

Here is what the researcher found, “…The seed yield of that variety is lower yielder and 10-12 % lower in oil content than the Ethiopian released variety Abaro.”

I believe you may have heard about the risk of channeling farmers to biofuel crops production in terms of jeopardizing food security.

This concern was also shared by the researcher. “Some of these areas are highly populated and if farmers are using the small land for castor than sweet potato, taro or yam then the chances of these peoples to be starved is great,” Rezene indicated.

Let’s now look the environmental damage report from the same paper. Rezene’s paper has indicated that some of these biofuel development companies in Ethiopia have cleaned dry forests and grazing lands such as, elephant sanctuary in eastern Hararghe to make bad things worse.

His findings are also backed by Forum for Environment, which as I remember was patron by the former President of the country Girma Woldegiorgis. “

Contributing factors

In my opinion some of the main reasons for the failure of all the biofuel investments in Ethiopia and the damage caused deliberately or unintentionally, includes the following, but not limited to.

- Lack of evidence based study

- Absence of transparency,

- Absence of detail regulation accountability (of investor and agency people – compensation mechanisms)

- No coordinated monitoring and evaluations mechanisms

There is no binding agreement or compensation mechanism if a company leaves the country after clearing the bushes and vegetation, like the damage made by most of these biofuel companies in areas such as Southern and Eastern Ethiopia.

In conclusion

Had Ethiopia’s biofuel development strategy was designed based on genuine motive of producing biofuel from jantropha and castor beans like Brazil, had enough evidences and facts about the potentials of the country for such investment and proper feasibility was done; there is no way for all the companies to fail to produce a single liter of biofuel. At least one company should have been producing biofuel after a decade.

Meanwhile all these companies have left the country or declared bankruptcy or shifted the money to another investment. But why? Is it because the incentives were not enough for them as believed by the new directorate in the Ministry of Mines, Energy and Petroleum, which is planning to revive these biofuel investments after a decade of failure? Or is it because the fuel price have gone down and discouraged the investment, as stated by one of the failed company representative?

If you ask me, none of the above will get Ethiopia the desired result and cut its fuel import bill. In my view the fact might be there was no enough evidence that proved the commercial viability of biodiesel development in Ethiopia in the first place.

There were also no regulatory monitoring, accountability and transparency mechanisms as well as no coordination among all involved government agencies to make biofuel development a reality at all.

I suggest it is time for the government to probe into the failures of each of these biofuel investments. The directorate at the ministry shouldn’t be allowed to design yet another plan, which includes more incentives to investors.

For this will definitely lead to the second round of wastage of natural resources and public finance. I think it is like doing the same thing again and again expecting different result.

I have no doubt that at least the tax fraud investigators and the National Bank of Ethiopia, which regulates the financial sector of the country, can learn a great deal from Ethiopia’s failed ‘biofuel Samba’, as my editor called it some years back, when I was frequently reported about the coming of these companies.

Who knows, the investigators could probably be able to prosecute those who misused the incentives and allowed the abuses. I think fining these guilty will result in warning those who are warming up for another round of biofuel samba or sugar, rice and palm oil dances to say the least.

In my view if a responsible government agency ignores to investigate the biofuel scam in Ethiopia with all the tips I just gave, means indirectly sponsoring damage of the environment and abuse of taxpayers’ money, which could have been invested I a more productive areas. This is just my take as a concerned citizen.