Ethiopian Airlines Group, which is 100 percent owned by the Government of Ethiopia, has investments in four African airlines and one logistics company.

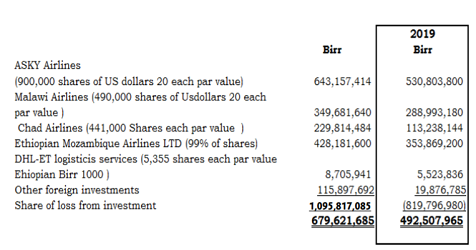

The gross profit of Ethiopian Airlines Group for the year ended June 30, 2020 has almost doubled to 13.44 billion Birr from about 7.74 billion Birr in 2019. Below are the list and the share of Ethiopian Airlines Group in the companies as of June 30, 2020:

1- 24% shareholding in African sky (ASKY) based in Lomé Togo,

2- 49% shareholding in Malawi Airlines based in Lilongwe Malawi,

3- 49% shareholding Tchadia Airlines,

4- 99% shareholding Ethiopian Mozambique Airlines LTD, and

5- 51% Shareholding DHL-ET Logistics Services.

In addition, Ethiopian airlines group has continued to form equity partnership with other airlines by way of investment in different African countries and has formed Zambia Airways with 45% shareholding. Zambia Airways is relaunched at the end of 2021.

Based on the official annual report of Ethiopian Airlines Group, outstanding balances at the year-end are interest free and settlements are to be made in cash. The report stated that for the year-ended 30 June 2020, Ethiopian Airlines Group has not maintained any provision for doubtful debts relating to amounts owed by ASKY, Malawi Airlines, Tchadia, Ethiopian Mozambique Airlines LTD and DHLET Logistics service.

Assessment is undertaken at the end of each reporting date through examining the financial position of the related parties and the market in which the related parties operate, according to the report.

“As at 30 June 2020, Ethiopian Airlines Group has due from ASKY Airlines Birr 83,164,910.75, Ethiopian Airlines Group has due from Malawi Airlines Birr 248,897,037.14, Ethiopian Airlines Group has due from Tchadia airlines Birr 36,115,197.92, Ethiopian Mozambique Airlines due from LTD Birr 375,393,370.25, and due from DHL-ET logistics service Birr 504,274.82. 38.

Ethiopian Airlines Group has established special purpose entities for the purpose of selling and leasing back aircraft and accessories. Those latter are registered in the names of the entities and either the assets or the entities themselves serve as collateral for loans.

No other material transactions have been carried out by the entities and all transactions are recognized in these financial statements. The Chief Executive Officer of Ethiopian Airlines Group authorized the issue of these financial statements on 23 March 2011, “the report stated.

“Ethiopian Airlines Group has commitments, not provided for in these financial statements of Birr 103,548,583,600 for the purchase of 41 aircrafts. Out of which Birr 42,675,432,800 is with the possibility of sale and lease back arrangement. Furthermore, there are additional commitment of Birr 5,352,270,000.00 the remaining cost for the construction of phase II Ethiopian Airlines Group Skylight Hotel. The commitments will be financed through long term Loan and partially through equity,” the annual Report stated.

The annual report also stated that Ethiopian Airlines Group has contingent liabilities, not provided for in these financial statements of Birr 408,463,926.99 in respect of legal actions brought by different organizations and individuals, which are being contested by Ethiopian Airlines Group. It is not possible to determine the outcome of these cases. The Ethiopian Airlines Group employed 13,556 staff at 30 June 2020 (2019- 13,953).

In addition to transportation of people and goods, the fully state-owned Ethiopian Airlines Group has invested in other related businesses including catering, aviation school, aircraft maintenance and hotel, among others.