By Andualem Sisay Gessesse –Ethiopia is battling to stop the outflows of billions of dollars every year through trade misinvoicing in collaboration with foreign partners, the country’s tax authority official said.

“As of last year, we are working hard to combat the practice, especially the under-invoicing by importers and local traders,” Sisay Baharu, Director of Planning and Performance Follow-up at the Ethiopian Customs and Revenue Authority (ERCA) said.

He made the comment reflecting on Global Financial Intelligence’s (GFI’s) report, which stated that close to two billion dollars on average is leaving the country every year through trade misinvoicing.

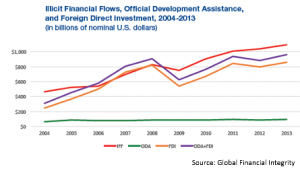

Out of the total of close to 26 billion dollars left Ethiopia as illicit financial flows in ten years (2004-2013), about $19.7 billion is left the country through trade misinvoicing, mainly by importers, according to GFI report released this month.

“In collaboration with Indian customs and excise, last year we have replaced the old system and established new custom data base, which is linked to global price makers and update itself automatically. In addition, we are also identifying the major importers in the country to do close follow up with our intelligence unit. We have also plan to continue using the public to inform us about such tax frauds and get paid up to 10% of the recovered stolen tax money,” he said.

Mr. Sisay also noted that the support from the International Monetary Fund (IMF) and Tax-Audit Transparency program by Her Majesty Revenue and Customs (HMRC) of British is also expected to enhance Ethiopia’s fight against illicit financial flows, which is now eating 5-10% of its GDP.

Ethiopia’s total income including tax, loan and aid has been growing by around 30% annually on average over the past five years reaching close to $9.1 billion in the last fiscal year (2014/15). Meanwhile the

country’s tax to GDP ratio still remains below 15% of the Sub Saharan Africa (SSA) average. Currently Ethiopia’s tax to GDP ratio is 13% as the tax authority was unable to achieve its target of bringing it up

to at least to the SSA average (15%).

Global picture

Misinvoicing covers 85% of the over a trillion dollars of money the developing countries have lost in the ten years covered that the report as illicit financial flows, according to the report that rated

China as the top victim of illicit financial flow.

China leads the world over the 10-year period with US$1.39 trillion in illicit outflows, followed by Russia, Mexico, India, and Malaysia. China also had the largest illicit outflows of any country in 2013,

amounting to a staggering US$258.64 billion in just that one year.

Compared to its Sub Saharan African neighbors, Ethiopia is being severely hit illicit financial out flows, according to the report. In those ten years, Uganda, Tanzania and Congo Kinshasa lost around $7.2 billion, $4.8 billion and $2.25 billion respectively.

Compared to its Sub Saharan African neighbors, Ethiopia is being severely hit illicit financial out flows, according to the report. In those ten years, Uganda, Tanzania and Congo Kinshasa lost around $7.2 billion, $4.8 billion and $2.25 billion respectively.

In Africa, South Africa is ranked top with $209 billion illicit flows, followed by Nigeria $178 billion, Morocco $41 billion, Egypt $39 billion, Zambia 28 billion and Cote de Voire $23 billion.

The fourth target of Goal 16 of the recently adapted Sustainable Development Goals (SDGs) replaced the Millennium Development Goals (MDGs), set target to significantly reduce illicit financial by 2030 and arms flows, strengthen the recovery and return of stolen assets and combat all forms of organized crimes.