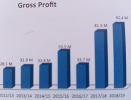

During the budget year concluded June 30, 2019, Oromia Insurance Company (OIC) has registered a gross profit (before tax) of close to 92.4 million birr (around $2.9 million at the current exchange), which is up about 14% from the previous budget year.

Meanwhile compared to the previous year, earning per share of OIC has declined by close to 5 percent to 390 birr (about $12.3) for par share value of 1,000 birr (about $31.5). Despite the stiff competition, OIC managed to perform well by generating gross written premium (GWP) of 434 million birr from non-life classes of businesses, which resulted in growth of 12.4 percent up from that of the last year’s GWP of 386 million birr (about $12.14 million), according to Abera Bekele (Eng.), Chairperson of Board of Directors at OIC.

He made the remark in message published on the annual report distributed to shareholders about a week ago at the annual general assembly. He stated that OIC, one of the private insurance companies in Ethiopia, has earned GWP of about 8.34 million birr (about $262,300) from life insurance business during the budget year concluded June 30, 2019, which is 32.2 percent greater than the previous year.

Some of the challenges of insurance industry in Ethiopia are deterioration of professional practices and unhealthy business competition, mainly confined on reduction of premium rate as well as shortage of insurance professionals, according to the annual report. During the year concluded June 30, 2019, the total asset of Oromia Insurance Company has reached 1.14 billion birr (about $36 million) with 371 employees with 47 market outlets. The report also shows that the sum insured of covered risks by OIC has reached 128.2 billion birr (about $4 billion) at the end of the year ended June 30, 2019.

Ethiopia’s insurance industry has generated gross written premium of 9.09 billion birr (about $286 million) showing a growth of 6 percent from that of the previous year’s 8.57 billion birr (about $269.5 million).

Currently there are 17 insurers in Ethiopia of which one is the state owned Ethiopian Insurance Company, while the remaining are private. Reports show that global insurance premiums has exceeded $5 trillion at the end of 2018 and is expected to grow by about 3 percent this year.