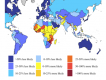

The World Bank forecasts Africa’s average economic growth to rise to 3.2 percent in 2018 and to 3.5% in 2019. The growth is expected as a result of improving commodity prices and expected gradual strengthening of domestic demand.

However, growth will remain below pre-crisis averages, partly reflecting a struggle in larger economies to boost private investment, according to the 2018 Global Economic Prospects of the World Bank released today. The global economic growth is expected to reach 3.1% for the same period.

South Africa is forecast to tick up to 1.1% growth in 2018 from 0.8% in 2017. The recovery is expected to solidify, as improving business sentiment supports a modest rise in investment. However, policy uncertainty is likely to remain and could slow needed structural reforms.

Nigeria is anticipated to accelerate to a 2.5% rate this year from 1% growth in the year just ended. An upward revision to Nigeria’s forecast is based on expectation that oil production will continue to recover and that reforms will lift non-oil sector growth. Growth in Angola is expected to increase to 1.6% in 2018, as a successful political transition improves the possibility of reforms that ameliorate the business environment.

Non-resource intensive countries are expected to expand at a solid pace, helped by robust investment growth. Côte d’Ivoire is forecast to expand by 7.2 percent in 2018; Senegal by 6.9%; Ethiopia by 8.2%; Tanzania by 6.8%; and Kenya by 5.5% as inflation eases.

However, given demographic and investment trends across the region over the longer term, structural reforms would be needed to boost potential growth over the next decade.

The regional outlook is subject to external and domestic risks, and is tilted to the downside. Although stronger-than-expected activity in the United States and Euro Area could push regional growth up due to greater exports and increased mining and infrastructure investment, an abrupt slowdown in China could generate adverse spillovers to the region through lower-than-expected commodity prices.

On the domestic front, excessive external borrowing without forward-looking budget management could worsen debt dynamics and hurt growth in many countries. A steeper-than-anticipated tightening of global financing conditions could also lead to a reversal in capital flows to the region. Protracted political and policy uncertainty could further hurt confidence and deter investment in some countries.

Rising government debt levels highlight the importance of fiscal adjustment to contain fiscal deficits and maintain financial stability. Structural policies—including education, health, labor market, governance, and business climate reforms—could help bolster potential growth, according to the report.