By Simiso Mlevu– Illicit financial flows (IFFs) in the artisanal mining sector in Zimbabwe are responsible for leakages of an estimated 3 tonnes of gold, valued at approximately USD157 million every month.

The sector has now spread its tentacles from alluvial gold deposits along rivers and dry riverbeds to large-scale disused mines that politicians and ruling party officials now patronize. This sector prominently emerged in the early 1990s because of the economic structural adjustment program (ESAP) which resulted in the massive retrenchment of labour by the government to satisfy conditionalities imposed by IMF and World Bank. Some retrenched workers turned to artisanal gold mining.

The growing number of artisanal miners, not only in Zimbabwe but the entire SADC region, culminated in the 1993 UN Interregional Seminar on the Development of Small and Medium-scale Mining in Harare which developed the Harare Guidelines on small-scale mining.

However, these efforts did not yield much in Zimbabwe as political elites quickly moved to capture the sector and kept it informal intentionally for them to harvest the artisanally mined gold. This led to a “Godfather syndrome” which saw powerful individuals with political connections tightly controlling artisanal gold mining at district and provincial levels.

Today, the sector is now largely characterized by lawlessness, violence and blatant disregard for human rights and reigns of terror through marauding gangs known as MaShurugwi (machete-wielding gangs).

The practice of artisanal mining is therefore illegal as it contravenes the Mines and Minerals Act [Chapter 21:05] which neither recognises nor defines an artisanal miner. Despite the illegality, in 2016 the Reserve Bank of Zimbabwe (RBZ) announced a policy of buying gold from artisanal miners on a “no questions asked” basis.

This was meant to bolster and boost gold deliveries and to expand the government’s revenue basket. Nevertheless, the RBZ’s Fidelity Printers and Refineries’ gold buying rates remain lower than black market rates, thereby fuelling side marketing and smuggling of gold. Organised syndicates comprising a few politically connected individuals sponsor the artisanal miners, manipulate security channels, have unlimited access to cash, and carry the contrabands out of the country through official ports of exit, sometimes in connivance with officials.

Gold dealers abuse their gold buying licences to fight for control of artisanal miners and gold millers. Through the patronage system, they also access cash for their illicit business from wealthy gold barons and Fidelity Printers and Refiners (FPR), the sole gold buying and 100% state-owned gold trading, refining and exporting company.

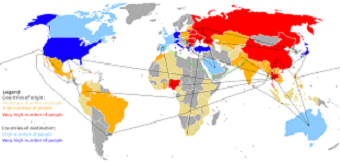

In Penhalonga, there are over 5000 gold pits that are controlled by one gold dealer while thousands of gold pits in Mazowe are also controlled by a few gold dealers registered with Fidelity Printers and Refiners. The gold dealers submit less than 30% of the gold to FPR, while the rest finds its way to South Africa, United Arab Emirates and other Asian countries such as China and India.

Most smugglers prefer to exit the country by road to South Africa where the gold is flown from. Sources told CNRG that some of the gold is flown out of South Africa by private planes from Lanseria Airport.

Gold barons sponsor a tightly monitored patronage system that is recruiting artisanal miners through political offices. Artisanal miners earn a pittance; in return, the gold baron gets lucrative rewards from the illicit trade. Although the gold smuggling syndicates ultimately boils down to a few gold barons and kingpins, the pyramid is very wide at the base with so many runners who operate numerous ‘offices’ for gold collection at the mines and in towns closer to the mines.

Gold leakages are rampant at the mining, milling and transportation levels of the supply chain. While there was no evidence to suggest the smuggling of gold from FRP, this institution remains responsible for creating arbitrage opportunities for the gold dealers who then choose to sell gold outside the country where there are better offers.

Section 17(2) of the Gold Trade Act mandates the Secretary of the Ministry of Finance or any person authorized by him to the issuance of gold buying/dealing licences. Previously the Ministry of Mines issued the licenses based on Gold Buying Regulations derived from the Gold Trade Act which states that the Minister of Mines may make regulations to further the effectiveness of the Gold Trade Act.

However, in a statement issued by the Reserve Bank of Zimbabwe on 26 May 2020, the central bank stated that “Small scale gold buying agents will have to enter into an agency agreement with FPR which contract shall spell out the terms and conditions under which the agents shall operate.”

The entry of small-scale gold dealers into the formal value chain has resulted in an opaque system of awarding these licenses without due process being followed and a system of patronage has arisen where only politically correct and connected individuals are awarded such licences as “fronts” for kingpins in the gold sector. Further, FPR has failed to proffer an efficient pricing mechanism to incentivize miners and maintain its regulatory role in gold trading in Zimbabwe

EDITOR’S NOTE: Simiso Mlevu is Projects & Communication for Development Centre for Natural Resources Governance (CNRG)