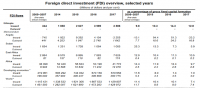

Foreign Direct Investment (FDI) into Ethiopia, the 8th largest economy in Africa, has declined by 10% to $3.6 billion in 2017 as compared to the previous year. Meanwhile the country has continued to attract investments in light manufacturing industries, says a UN report.

This is indicated by the World Investment Report 2018 launched today by United Nations Conference on Trade (UNCTAD). Meanwhile Ethiopia is the second largest recipient of FDI in Africa after Egypt, despite its smaller economy (the eighth largest in Africa), according to the report.

Chinese and Turkish firms announced investments in light manufacturing and automotive after Ethiopia lifted the state of emergency in the second half of 2017.

United States fashion supplier PVH (Calvin Klein and Tommy Hilfiger); Dubai-based Velocity Apparelz Companies (Levi’s, Zara and Under Armour); and China’s Jiangsu Sunshine Group (Giorgio Armani and Hugo

Trend of FDI into Ethiopia- Source UNCTAD

Boss) all set up their own factories in Ethiopia in 2017.

Several of these firms are located in Ethiopia’s flagship, Chinese-built, Hawassa Industrial Park.

Kenya, Tanzania

East Africa, the fastest-growing region in Africa, received a total of $7.6 billion in FDI in 2017, a 3% decline from 2016. Ethiopia absorbed nearly half of this amount, with $3.6 billion.

Kenya saw FDI increase to $672 million, up 71 per cent, due to buoyant domestic demand and inflows into ICT industries. The Kenyan Government provided additional tax incentives to foreign investors. South African ICT investors Naspers, MTN and Intact

Software continued to expand into Kenya.

United States companies were also prominent tech-oriented investors, with Boeing, Microsoft and Oracle all investing in the country. Significant consumer-facing investments by Diageo (United Kingdom) in beer and Johnson and Johnson (United States) in pharmaceuticals also bolstered FDI into the country.

The strong gold price and a diversified productive structure contributed to FDI inflows worth $1.2 billion into the United Republic of Tanzania.

Facebook and Uber (both United States) expanded into that country while India’s Bharti Airtel continued to invest. The country’s inflows nonetheless recorded a 14 per cent decline compared with 2016.

Foreign telecommunication companies now must list at least a quarter of their equity on the local stock exchange, an effort by the Tanzanian Government to increase domestic ownership.

In addition, a ban on exports of unprocessed minerals may adversely affect the country’s foreign mining assets.

Angola, South Africa

In Southern Africa, FDI declined by 66 per cent to $3.8 billion. FDI into Angola, Africa’s third largest economy, turned negative once again (–$2.3 billion from $4.1 billion in 2016) as foreign affiliates in the country transferred funds abroad through intra-company loans.

In addition, oil production declined and macroeconomic fundamentals deteriorated.

Tenders for onshore oil blocks were suspended in 2017 but are to be re-launched in 2018 after a new government is appointed. A tender for oil blocks off southern Angola may also be opened in 2018 to offset declines in older fields.

FDI to South Africa declined by 41 per cent to $1.3 billion, as the country was beset by an underperforming commodity sector and political uncertainty.

Investors from the United States, which remain the largest source of FDI into the country, focused on services industries. The standout project was the investment by DuPont (United States) into a regional drought crop research centre.

Automotive FDI also remained significant. General Motors sold its South African plant to Japan’s Isuzu, and Beijing Automotive Group Co. announced an $88 million investment in a vehicle manufacturing plant in a joint venture with South Africa’s Industrial Development Corporation.

European investors, led by Germany and the United Kingdom, remained very active in South Africa, through initiatives such as BMW’s retooling of factories. Automotive FDI into South Africa is increasingly developing regional value chains: Lesotho now produces car seats, and Botswana ignition wiring sets, for auto manufacturers in South Africa.

Mozambique

FDI into Mozambique also contracted severely, down 26 per cent to $2.3 billion, amid austerity and debt defaults. Long-term prospects rely on the country’s liquefied natural gas potential being exploited and profits reinvested to advance domestic development.

Mozambique’s coal sector attracted investor interest from a consortium of Chinese, British and South African firms, but the project is in its early stages.

Zambia

FDI into Zambia, by contrast, increased by 65 per cent, to $1.1 billion, supported by more investment in copper. The Government, which is keen to diversify the economy away from copper, announced the building of a $548 million cement plant in a joint venture between the country’s mining investment arm and China’s Sinoconst. Israeli Green 2000, already active in seven other African countries, also invested in food production, further contributing to economic diversification.

Geographical sources of FDI to Africa are becoming more diversified.

Investors from the United States, the United Kingdom and France still hold the largest direct investment stakes in Africa. Italy has also emerged as a major source of investment, particularly in the energy sector.

At the same time, developing-economy investors from China and South

Africa, followed by Singapore, India and Hong Kong (China), are among the top 10 investors in Africa. China’s FDI stock in the continent reached $40 billion in 2016, as compared with $16 billion in 2011.