African Continental Free Trade Area (AfCFTA) is expected to increase intra-African trade in transport services by nearly 50%, according to the latest estimates by the Economic Commission for Africa (ECA).

The estimates on, ‘Implications of the African Continental Free Trade Area for demand for transport, infrastructure and services’, released by ECA at the fifth African Business Forum on February 7, indicate that with AfCFTA in absolute terms, over 25% of intra-African trade gains in services would go to transport alone; and nearly 40% of the increase in Africa’s services production would be in transport.

The research conducted by experts in the Energy, Infrastructure and Services Section of ECA unpacks AfCFTA investment opportunity in the transport sector.

Vera Songwe, UN Under-Secretary-General and Executive Secretary of the ECA said the AfCFTA is “expected to significantly increase traffic flows on all transport modes: Road, Rail, Maritime, and Air,” but that such gains will only be optimized if the AfCFTA is accompanied by implementation of regional infrastructure projects.

Robert Lisinge, Chief of the Energy, Infrastructure and Services Section at ECA, said “roads currently carry the lion’s share of freight in Africa.” He pointed out that the “AfCFTA provides an opportunity to build Africa’s railway network. It would increase intra-Africa freight demand by 28%; demand for maritime freight will increase the most.”

According to the research findings, AfCFTA requires 1,844,000 trucks for bulk cargo and 248,000 trucks for container cargo by 2030. This increases to 1,945,000 and 268,000 trucks respectively if planned infrastructure projects are also implemented.

The largest demand for trucks to support AfCFTA is within West Africa (39%); demand from West to Southern Africa is 19.8% and from Southern Africa to Western Africa by 9.9%.

The key questions considered for research were how will implementation of AfCFTA affect demand for transport infrastructure and services? What would be the demand for different modes of transport, and what are the implications for investment in infrastructure development? What would be the infrastructure and equipment needs for different transport modes?

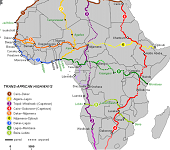

Mr Lisinge noted that AfCFTA and Africa’s transport infrastructure programmes are intrinsically linked and should be implemented simultaneously. He said the Trans-African Highways (TAH) & Programme for Infrastructure Development (PIDA) and the Single African Air Transport Market (SAATM) should be prioritised at the same level with AfCFTA.

Road Transport

“Africa’s road network is inadequate but implementing planned projects will significantly increase its size. Africa needs to upgrade sections of its roads to cope with increased freight generated by AfCFTA,” said Mr Lisinge.

“Freight traffic growth envisaged to be higher in some sections of Africa’s road network than continent-wide average growth. Implementing AfCFTA will double road freight from 201 to 403 million tonnes.”

Implementing TAH and PIDA projects, he said, increases capacity of transport networks to accommodate freight growth. Reaping the huge benefits of AfCFTA to the transport sector requires implementation of regional infrastructure and services programmes.

Rail Transport

On the rail transport, ECA estimates show that Africa’s rail network is inadequate, but implementing PIDA and other planned projects will significantly increase its size. Implementing planned projects will increase the network by almost 26,500km.

AfCFTA requires 97,614 wagons for bulk cargo and 20,668 wagons for container cargo by 2030. This increases to 132,857 and 36,482 wagons respectively if planned infrastructure projects are also implemented.

Maritime

Implementing AfCFTA would double maritime freight from 58 to 131.5 million tonnes. Africa’s maritime network includes 142 links connecting 65 ports; accounts for 22.1% of intra-African freight transport. Share will increase by 0.6% to 22.7% if both AfCFTA and planned infrastructure projects are implemented.

AfCFTA requires 126 vessels for bulk cargo and 15 vessels for container cargo by 2030. This reduces to 121 and 14 vessels respectively if planned infrastructure projects are also implemented.

Air transport

The continent’s air transport network includes a total of 14,762 air routes (connecting each airport with the other 121 airports).

Implementing AfCFTA would double the number of tonnes transported by air from 2.3 to 4.5 million.

In 2019, air accounted for only 0.9% of intra-Africa freight transport Implementation of AfCFTA would double airfreight from 2.3 to 4.5 million tonnes. Air traffic is therefore expected to double in 2030 compared to 2019.

African Continental Free Trade Area (AfCFTA) Agreement entered into force in 2019. Implementation commenced in 2021. Negotiations are still ongoing on investment, intellectual property rights, competition policy and e-commerce. AfCFTA’s objective is to create single continental market for goods & services, with free movement of people and investments, enhancing competitiveness and supporting economic transformation.