The World Trade Organization (WTO) says the third quarter of 2024 saw services exports rise by 16 percent in Asia, followed by 8 percent in Europe, while North America, South and Central America and the Caribbean expanded by 7 percent.

Marked growth was also recorded on imports across regions, reflecting high demand for diverse services. Services are the bright spot of trade, with growth of 9 percent year-on-year in the first three quarters of 2024. This is in sharp contrast with goods trade, which was up by only 2 percent over the same period.

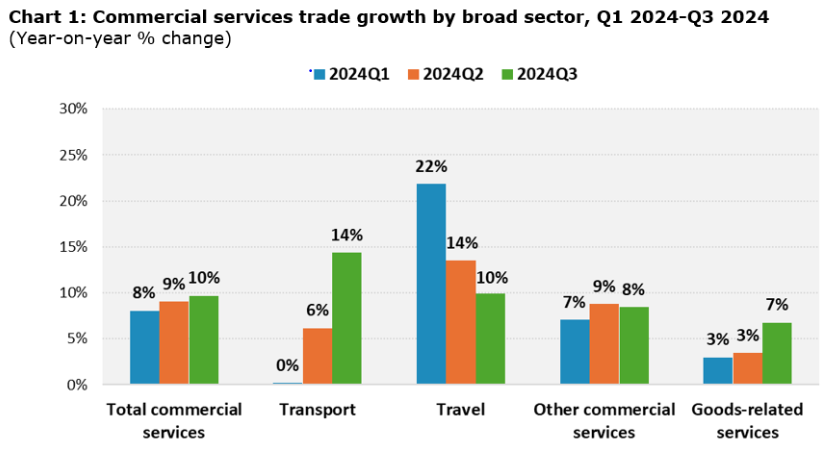

In the third quarter of 2024, transport saw a 14 per cent rise (Chart 1) as shipping rates climbed amid persistent disruptions on major trade routes. Global freight prices were nearly four times higher than in Q3 2023, at about US$ 4,500, according to data from Freightos.

Asia’s transport services exports increased by 32 per cent, with peaks of 47 percent in China and 40 per cent in Singapore. Available monthly statistics of leading Asian transport traders point to sustained growth through the end of the year. For example, in the last quarter of 2024, China’s transport exports soared by 50 percent, reflecting a surge in shipments.

International travelers’ expenditure in foreign economies increased by 10 per cent in Q3 2024, and in the first three quarters of 2024, global travel receipts were 15 per cent higher than pre-pandemic levels. Growth is stabilizing after the post-pandemic surge, and visa-free schemes adopted throughout 2024 by many economies have benefited international tourism worldwide. By the end of 2024, international tourist arrivals had almost reached their 2019 levels, suggesting complete recovery for the sector, according to UN Tourism.

Travel in 2024 was also boosted by the UEFA European Football Championship in Germany and the Olympics in France, and Europe’s travel exports grew by 7 per cent from an already high base in 2023. Many African economies recorded double-digit growth, including Namibia (+32 percent), Morocco (+19 percent) and Tanzania (+18 per cent).

Other commercial services, a heterogeneous group of services accounting for some 60 per cent of total services trade, expanded on average by 8 percent in Q3. In the European Union and the United Kingdom, exports in this category increased by 9 per cent, and in the United States by 7 percent. Double-digit growth was widespread in many economies in different regions. For example, South and Central America and the Caribbean economies saw very high growth rates, including Chile (+32 percent), Argentina (+26 percent) and Peru (+17 percent).

Digitally deliverable services such as computer, financial, business and insurance services were the main drivers of growth. Computer services continued their impressive rise in January-September 2024, with cumulative exports surging globally by 13 per cent (Chart 2). Rapid growth in computer services exports was recorded both in developed and developing economies, including a sharp increase of 77 percent in Indonesia and strong growth of 37 percent in Mauritius and 18 per cent in the United States. According to WTO estimates, the European Union’s exports of computer services grew by 15 per cent year-on-year in the first nine months of 2024, or by 10 percent if excluding the largest EU exporter, Ireland.

Companies are increasingly outsourcing information technology (IT) services and software development. The rapid expansion of e-commerce and digital platforms, including in developing economies, has accelerated this process. The growing adoption of AI, such as to develop chatbots, machine learning and predictive analytics, as well as for cybersecurity needs, has further accelerated the global demand for computer services. This trend is expected to persist as businesses adapt to new technologies and consumer preferences for digital solutions.