The African Development Bank (AfDB) and OpenOil, a Berlin-based financial analysis firm, have jointly produced a report on how African governments use financial models to manage oil & gas and mining projects.

The report was launched at the 13th Annual General Meeting of the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) in Geneva, Switzerland.

Over 150 experts and representatives of international development institutions, governments, civil society and extractives companies attended the launch. These included the World Bank, United Nations Environment Programme (UNEP), United Nations Development Programme (UNDP), United Nations Conference on Trade and Development (UNCTAD), Organisation for Economic Co-operation and Development (OECD).

Mining companies and miners’ associations such as Newmont Mining Corporation, AngloGold Ashanti, Anglo American and International Council on Mining and Metals (ICMM) also attended. The joint report was presented by Pietro Toigo of the AfDB’s African Natural Resources Center and Olumide Abimbola from OpenOil.

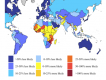

The report, Running the Numbers: How African Governments Model Extractive Projects, analyses the capacity of 19 African resource-rich countries to use financial models, which simulate a simplified version of a real-world project in order to determine their financial benefits to the countries. AfDB and OpenOil conducted a survey of nearly 50 government officials to illustrate not only how widespread use of financial models is, but also how their results are utilised to inform policy.

“Financial models are essential throughout the life-cycle of extractive projects,” said Johnny West, Director of OpenOil. “They are not just important during the development of the fiscal regime, but also for the negotiation of fiscal terms with companies, for revenue forecasting, and for auditing and tax-gap analysis.”

“This report not only stresses the need for African Governments to make efforts to close the information gap with extractive companies, but also shows where there are capacity gaps and how those gaps could be addressed,” Traore said, urging development partners to invest more in capacity building.

Also, there is a substantial gap in access to data that are key inputs for financial models in African countries, with the largest gaps in assessing information on capital costs and operating costs of projects.

In addition to the need to build in-house financial modelling capacity, the report suggests that governments need to improve internal business processes and address the large gap that the report shows exist between information available to different agencies, departments and ministries.

“This study forms a crucial part of the Center’s support to African countries in realising the full potential of their natural resources”, Traore said. “How are countries supposed to enter into negotiations with extraction companies that use financial models if the governments of such countries are not in possession of the latest and best models to calculate what a potential project is worth?” Toigo asked.

The report also encourages development partners to make capacity building in financial modeling a more significant part of their support to the management of extractive resources. Partners doing so already were encouraged to not just supply financial models as part of isolated technical assistance, but to also invest in equipping government officials with skills to create and use models.