By Anwar Hussen Mohammed – The stock market offers the potential for high returns, but it’s important to be aware of the inherent risks involved. Unfortunately, there’s no guaranteed way to pick a constantly profitable stock market.

The market itself is inherently volatile, and what appears promising today can change course quickly. But first let’s look at some of the major risks you should consider before investing:

Market Risk (Systematic Risk):

• This is the overall risk of the stock market itself. Stock prices can fluctuate due to various economic factors, interest rates, political events, and even global crises.

• Even if you carefully choose individual stocks, a downturn in the entire market can cause your portfolio to lose value.

Company Risk (Unsystematic Risk):

• This risk is specific to individual companies or industries. A company’s performance can be negatively affected by factors like poor management, product recalls, or changes in consumer preferences.

• Diversification helps mitigate this risk by spreading your investments across different companies and sectors.

Liquidity Risk:

• This refers to the ease with which you can buy or sell an investment. Some stocks, particularly those of smaller companies, may be less liquid and take longer to sell when you need the money.

Inflation Risk:

• Over time, inflation erodes the purchasing power of your money. If your investments don’t keep pace with inflation, you’ll lose value in the long run.

Volatility Risk:

• Stock prices naturally fluctuate, and some stocks experience more significant swings than others. This volatility can be unnerving for new investors, but it’s a normal part of the market.

Other Risks:

• Currency Risk: If you invest in international stocks, exchange rate fluctuations can impact your returns.

• Interest Rate Risk: Rising interest rates can make bonds more attractive than stocks, potentially leading to a stock market decline.

• Credit Risk: If a company you’ve invested in issues bonds and defaults on its debt, you could lose your investment.

By understanding these risks and creating a well-diversified portfolio with a long-term perspective, you can become a more informed and prepared investor. But still entering the stock market can be exciting, but it’s also important to be prepared.

Here are some key pieces of advice for beginner investors:

Before You Invest:

• Define Your Goals: Are you saving for retirement, a down payment on a house, or a short-term goal? Knowing your goals will help determine your investment timeline and risk tolerance.

• Risk Tolerance: Everyone has a different comfort level with risk. Be honest with yourself about how much volatility you can handle. Generally, younger investors have a longer time horizon and can tolerate more risk.

• Educate Yourself: There’s a wealth of information available online and at libraries. Learn about different investment options, asset allocation, and basic financial concepts.

Building Your Portfolio:

• Start Small and Invest Regularly: Don’t jump in head first. Begin with a smaller amount you can comfortably afford and invest consistently over time. This is called “dollar-cost averaging” and helps reduce risk from market fluctuations.

• Diversification is Key: Don’t put all your eggs in one basket. Spread your investments across different asset classes like stocks, bonds, and ETFs (Exchange-Traded Funds). This helps mitigate risk if one sector performs poorly.

• Consider Low-Cost Index Funds: Index funds are a popular option for beginners. They passively track a market index, offering broad diversification and typically lower fees than actively managed funds.

Investing Strategies:

• Long-Term Focus: The stock market has its ups and downs, but historically, it has trended upwards over the long term. Resist the urge to make emotional decisions based on short-term fluctuations.

• Beware of Get-Rich-Quick Schemes: If something sounds too good to be true, it probably is. Avoid chasing hot tips or investing in individual stocks you don’t understand.

• Don’t Panic Sell: Markets can be volatile, but drastic selloffs during downturns can lock in losses. Stick to your investment plan and avoid emotional reactions.

Strategies

Market Research and Analysis:

• Economic Conditions: Research the overall health of the global and domestic economies. Strong economies tend to support rising stock markets.

• Industry Trends: Identify industries that are positioned for growth based on technological advancements, demographics, or consumer behavior. Look for sectors with strong fundamentals and limited competition.

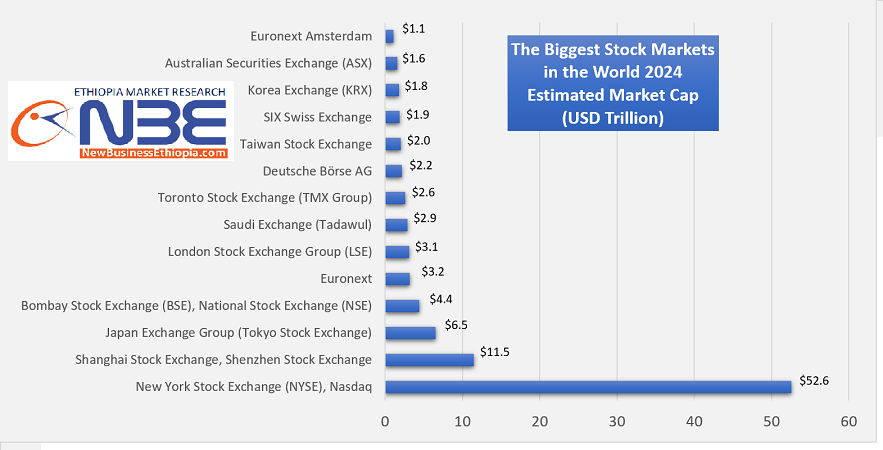

• Exchange Performance: Investigate the historical performance of different stock exchanges. Some exchanges may be experiencing a boom due to specific factors, while others might be stagnant.

Focus on Company Fundamentals:

• Financial Performance: Analyze company financials such as revenue growth, profitability (earnings per share), and debt levels. Look for companies with a consistent track record of financial stability and growth.

• Management Strength: Research the company’s management team and their experience. Strong leadership is crucial for navigating challenges and driving long-term success.

• Competitive Advantage: Identify companies with a sustainable competitive advantage, such as a unique product, strong brand recognition, or a dominant market share.

Consider Diversification Strategies:

• Geographic Diversification: Don’t limit yourself to your domestic market. Look for promising companies in emerging markets or established economies with strong growth potential.

• Industry Diversification: Spread your investments across different industries to mitigate risk. A downturn in one sector might be offset by gains in another.

• Asset Allocation: Consider incorporating different asset classes like bonds and ETFs (Exchange-Traded Funds) into your portfolio alongside stocks. This helps reduce overall portfolio volatility.

Additional Tips:

• Beware of Chasing Hot Tips: Don’t blindly follow stock recommendations without researching the underlying company.

• Long-Term Investing: Focus on building a portfolio for the long term, ideally 5-10 years or more. This allows you to ride out market fluctuations and benefit from potential long-term growth.

• Invest What You Can Afford to Lose: Only invest money you can comfortably afford to lose. The stock market is not a guaranteed path to riches, and there is always a risk of losing your investment.

Remember, even with careful research and planning, stock market success is not guaranteed. There will be ups and downs. By employing these strategies and staying informed and educating yourself, you can make informed investment decisions and increase your chances of building a healthy portfolio over time.