From October 2022 to September 2023 Ethiopia’s coffee exports are anticipated to increase to a 4.72 million bags, a record (280,560 metric tones – MT) from 282,000 MT the previous year, says a new report.

During this period Ethiopia is expected to produce 8.25 million 60-kilogram bags of coffee (495,000 MT), according to the report released a few weeks ago by United States Department of Agriculture. More than 15 million smallholder farmers and other industry participants rely on coffee as their primary source of income in Ethiopia. Last Ethiopian budget year 2021/22, Ethiopia’s coffee exports totaled 4.70 million bags (282,000 MT).

In 2020 and 21 Ethiopia’s top export markets were Germany, Saudi Arabia, the United States, Belgium, and Japan. 3.45 million bags (207,000) are anticipated to be consumed locally in MY 2021/22.

Production

The world’s first arabica coffee was introduced by Ethiopia. Although delayed rains in the southern areas were noticed without having a significant impact other than to extend harvest in the region, the weather in 2021/22 has been generally favourable throughout the production year with minimal insect and disease infestation in the coffee growing regions.

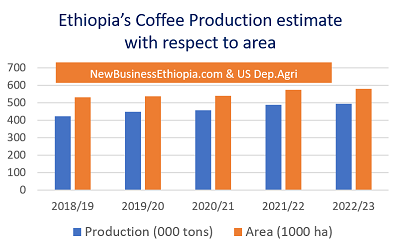

Ethiopia is the world’s third-largest arabica coffee producer and the greatest producer of coffee in Africa as of 2022, with a production that has slowly increased from 6 million to over 8.15 million bags in the past ten years. The coffee seedling that was recently planted and grew for five to ten years is now producing.

The production of coffee is anticipated to increase by 100,000 bags in 2022–2023 to 8.25 million bags (495,000 MT), assuming favorable weather, low insect and disease pressure, and sufficient rain. In comparison to our forecasts for 2019–20, which were 7.6 million bags, the estimate for coffee output in 2020–21 has been increased to 8.15 million bags.

The increased yields seen in the coffee producing belts, particularly in the southern and western regions, as well as the introduction of new trees for harvesting are the key causes of the increase in production volume. During the MY 2020/21 coffee growing season, the amount and distribution pattern of rain was normal to higher than typical, according to the report.

Due to Coffee Berry Disease, coffee experts are also advising coffee farmers to implement all feasible phytosanitary measures, such as regular field monitoring to uproot and burn infected coffee trees (CBD).

Sun-drying and wet processing are the two most popular coffee processing techniques. Currently, 20–30% of Ethiopian coffee is washed, and 70–80% is unwashed or sun-dried. In many areas, including the United States where consumers prefer “cleaner” cleaned coffee, unwashed coffee is sold for less money.

Other nations, like Japan, insist on unwashed coffee in order to give it a more authentic and flavorful taste. Leading khat producers in East Africa include Ethiopia. A bushy plant called khat is utilized to stimulate. Some regions of the nation’s farmers have switched from growing coffee to just khat in recent years.

It is a drug banned in most countries but legal in Ethiopia and neighboring countries. The transition has led to greater farmer incomes but also declines in food security, biodiversity, soil health, and women’s empowerment.

Although it is illegal in the majority of nations, Khat is lawful in Ethiopia and its bordering nations. Increased farmer incomes have been accompanied by reductions in soil health, food security, biodiversity, and women’s empowerment.

To make the same amount of money as one pound of khat, a farmer would require ten coffee trees. Compared to coffee, khat plants require less maintenance and are drought resistant, while one coffee plant produces 8 to 12 kg of berries.

The Ethiopian government (GOE) does not support the production of khat in any way and does not take any action to prevent its growth, trade, or use. The local taxation of khat and its export bring in a sizable sum for the GOE.

Ethiopia opened a cutting-edge coffee training facility in June 2021 to provide practice-based training that is modular in nature with the goal of improving the sustainability and value chain in the nation’s coffee sector. The facility is housed on the grounds of the Ethiopian Coffee and Tea Authority (ECTA) in Addis Ababa.

The facility offers training courses on the principles of coffee, processing, drying, and storing, as well as trade and equipment maintenance. When Ethiopia exports coffee, there are four criteria that are taken into account:

– Certification (e.g., Fair-trade)

– Coffee grade and coffee cupping tests.

– Geographical origin: from well-recognized geographical location in particularly Harar and

Yirgacheffe.

– Post-harvest treatment: sun dried or washed coffee.

These high-quality coffees make up an estimated 25% of export quantities and are occasionally referred to as specialty coffee.

Consumption: Ethiopians are among the continent’s biggest coffee drinkers, and the trend there is steadily increasing. 3.5 million bags of domestic coffee will be consumed in MY 2022/23, according to forecasts (210,000 MT).

Post anticipates 3.45 million bags of local consumption during MY 2021–2022. (207,000 MT). The majority of coffee bought on the local market was either rejected or did not fulfil the requirements set by the Ethiopian Commodity Exchange (ECX) for export quality.

However, for arabica coffee, local prices are typically greater than those found elsewhere. Ethiopians’ social and cultural lives depend heavily on coffee.

Due to better export coffee prices over the past two years, coffee prices on the local market are rising annually.

Trade

The Ethiopia Coffee and Tea Authority report states that during the first half of the current fiscal year (2021/22), Ethiopia’s six-month coffee export earnings increased by $274 million to reach more than half a billion U.S. dollars.

Currently, Ethiopia exports more than 1000 tons of coffee every day. According to the six-month income total, coffee is Ethiopia’s best-performing export.

Around 5% of coffee production is anticipated to be diverted to the black market and cross-border trade in 2021/22, with the remaining 42% going to the domestic market. The remaining 58% is directed toward the export market, with 80–85% of that going through the ECX, 5–10% going directly through cooperatives, and the remaining 5% going through commercial farms.

Only in January 2022, Ethiopia sold about 11,200 bags (672 MT) of coffee online during the launch of Ethiopian coffee brands on China’s largest E-commerce platform, Alibaba (Tmall Global), as a result of collaboration with the Government of Ethiopia and the United Nations Economic Commission for Africa (ECA).

The frequent droughts and frosts that reduced the quantity and quality of coffee arabica production in South American coffee-producing regions are the main causes of Ethiopia’s rising coffee exports.

Policy

A lot of coffee traders used to export their products at a loss in order to gain more foreign currency, and then they would use that money to acquire things like cars and building supplies, which they would then resell locally at a large profit.

The price of agricultural items on the market was distorted by this approach, according to the report. The Coffee and Tea Authority collaborated with the National Bank of Ethiopia on January 28, 2020, to create a policy known as the “Export Coffee Contract Administration.”

This directive establishes a minimum export price for coffee based on the weighted worldwide average price paid for various grades of coffee from various areas. Exporters, coffee roasters, and coffee farmers are all impacted by this regulation.

Coffee exporters deliver their contracts to the Ethiopian National Bank (NBE). Each day’s contracts are given to an Association-team by the NBE. The team contrasts the costs with local and worldwide coffee pricing. They then determine a new minimum price using an average weighted formula. The contract pricing for coffee exporters are based on the new minimum the next day.

Ethiopian coffee exporters are required under the minimum coffee price regulation to sell their beans at or above a set minimum price. The government and Ministry of Trade will take legal action if exporters provide less than the required price.

NBE has released a directive restricting the amount of foreign currency exporters can keep and utilize for acquiring other commodities from their export earnings due to the severe shortage of foreign currency in the nation.

This new guideline somewhat restricts the quantity of import of other products and services because the majority of exporters utilize coffee export revenues to pay for their imported goods and services. According to the guideline, only 20% of the money earned by coffee exporters through export may be kept in USD for their import.

To be used locally, the remaining earnings must be converted to Birr. Exporters have expressed some displeasure with this directive, which has sparked movements to increase the 20% cap in opposition to the new rule.