Control Risks, the global investment risk assessment agency, and its economics consulting partner, Oxford Economics Africa, launch of the ninth edition of the Africa Risk-Reward Index highlighting key opportunities and challenges.

This authoritative report is designed to provide policymakers, business leaders, and investors with a comprehensive guide to navigating the evolving investment landscape across key African markets. The report is released at a time when Africa is experiencing a significant generational shift in politics, increased continental connectivity, and the rapid emergence of transformative technologies that could potentially propel its progress. This pivotal moment presents both opportunities and challenges for businesses operating in African markets, but also risks exacerbating fragilities in some African countries.

Africa’s outlook is promising. But understanding the nuanced market dynamics and adopting a long-term perspective will be essential for stakeholders — from policymakers and investors to development agencies and civil society — as they navigate the evolving landscape to successful investment outcomes in 2024 and beyond. For African countries and investors looking to invest or grow their business in Africa, the time is now.

In the ninth Africa Risk-Reward Index, Control Risks and Oxford Economics Africa compare some of the continent’s largest and emerging markets, offering investors a comparative snapshot of market opportunities and risks across Africa in the year ahead.

The report examines three key themes outlined below, summarizing Control Risks’ and Oxford Economics Africa’s views on Africa’s trajectory in the year ahead.

Bridging the generational divide – a new era for African politics

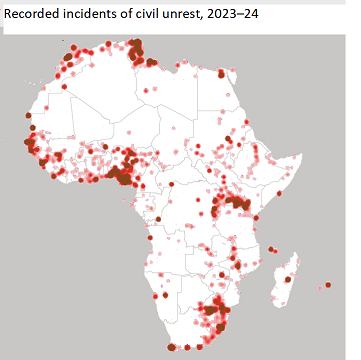

The report’s first theme focuses on how African political leaders are increasingly mindful of their young, growing populations. Recent events have shown that young people are becoming more frustrated with governance, impatient with development, and disillusioned with political establishments. This discontent has manifested in some surprising election results, youth-led protests, and some policy shifts.

Patricia Rodrigues, Associate Director at Control Risks, said, “The 2024 Africa Risk-Reward Index provides crucial insights into the dynamic changes shaping investment opportunities across the continent. As Africa faces a period of significant political and economic shifts, our report highlights both the potential rewards and the risks that investors must consider. This year’s edition emphasizes the importance of understanding the complex interplay between emerging technologies, infrastructure developments and geopolitical influences to make informed and strategic investment decisions.”

In South Africa, the ruling party lost its parliamentary majority in the May 2024 elections. In Senegal, the opposition candidate achieved a resounding victory, further illustrating the changing political dynamics in the region. In Kenya, young people organized nationwide protests that led the president to dismiss the entire cabinet.

Businesses must now operate in a less predictable security and policy environment, as governments strive to balance investment attraction with rising societal demands.

White elephants and lifelines – the megaprojects reshaping the continent

Over the past decade, Africa has witnessed a significant surge in infrastructure investment, with large-scale energy, port, and rail projects taking center stage. These megaprojects are often seen as catalysts for transformative economic growth, addressing long-standing deficiencies in trade corridors and enhancing connectivity across the continent.

However, these ambitious projects are not without their challenges. Questions about these ventures’ true cost, long-term utility, and the transparency of the deals underpinning them have sparked heated debates across the continent. Many of these megaprojects have been financed through government-to-government agreements, often accompanied by concerns over opaque terms, lack of local involvement, and the potential for unsustainable debt burdens.

Geopolitical dynamics also play a significant role in shaping Africa’s infrastructure landscape. While China has historically dominated infrastructure investment on the continent, other global powers are increasingly vying for influence. The US, Gulf countries, and other geopolitical actors are stepping up their efforts to fund and develop critical infrastructure projects in Africa, driven by competition for access to natural resources and strategic positioning in the global economy.

This has resulted in a more complex and competitive environment, where African governments and businesses alike have to carefully navigate competing interests and align their infrastructure needs with their long-term goals.

Emerging technologies – supercharging economic development

The advent of artificial intelligence (AI) is poised to unlock new opportunities for innovation across Africa. AI applications in agriculture, climate adaptation, healthcare, and education offer the potential to accelerate economic growth. However, African governments risk lagging their global counterparts in regulating these technologies. Countries like Morocco, Rwanda, and South Africa are taking proactive steps, but others may adopt a more cautious approach, leading to a fragmented regulatory landscape.

Jacques Nel, Head of Africa Macro at Oxford Economics Africa, added, “The 2024 Risk-Reward Index reveals a continent in flux, where significant shifts in political landscapes and economic conditions are reshaping the investment environment. This year’s report highlights the dual nature of Africa’s growth prospects – offering substantial opportunities while also presenting considerable risks. Our insights aim to equip stakeholders with the knowledge needed to make strategic decisions and utilize all the continent has to offer for sustainable growth.”

Investment Landscape Outlook

The 2024 Africa Risk-Reward Index continues to provide a grounded, long-term perspective on investment opportunities and challenges across major African economies. The report examines the shifting economic and political dynamics that are reshaping the continent’s risk-reward profile and offers actionable insights for stakeholders seeking to make informed decisions in this complex environment.

African countries are at the intersection of global competition for resources, new trade corridors, and digital innovations. This index serves as a valuable tool for those looking to navigate the continent’s diverse markets and capitalize on emerging opportunities.