The United Nations Economic Commission for Africa (ECA) has called for an inclusive international tax system and an overhaul of the global financial system as part of a global deal to secure the Sustainable Development Goals (SDGs) and enable African countries to focus their resources on sustainable and inclusive development.

Speaking at a meeting of the Second Specialized Technical Committee on Finance, Monetary Affairs, Economic Planning, and Integration of African Union whose Sub-Committee on Tax and Illicit Financial Flows is in session, Acting Executive Secretary Antonio Pedro made this call while highlighting the challenges facing African countries in generating domestic resources for economic, social, and environmental investment. According to Pedro, “the fiscal deficit in Africa is estimated at 5% of GDP in 2022 and expected to remain higher than pre-pandemic levels.”

Pedro stressed the need to raise additional resources as African countries face multi-faceted challenges, adding that a double-digit growth rate is needed to rescue the SDGs and accelerate the implementation of Agenda 2063. However, the question remains, where does this growth rate come from?

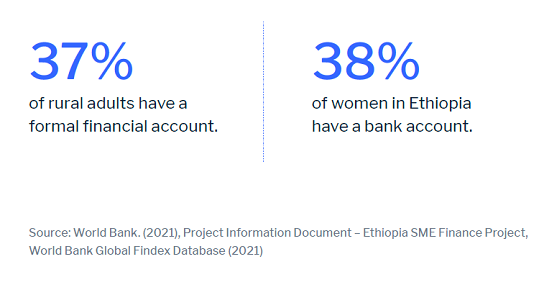

Noting that the international financial architecture remains grossly inadequate for low-income countries, especially in Africa, to respond to the imperatives of the SDGs and transform Africa’s economies, he said that multilateral financing “is increasingly becoming inadequate and unfavourable and that international private financing is equally challenging and costly owing to poor credit ratings stemming from structural issues and systematic bias.”

Reiterating the UN Secretary-General’s recent call for a global deal that enables developing countries to focus their resources on sustainable and inclusive development and avoid a breakdown of the global order, he called for “a complete overhaul of the global financial system, the creation of an operational debt relief and restructuring framework, strengthened domestic resource mobilization and an inclusive international tax system.” He also stressed the need for concerted efforts at the national, regional, and global levels and lauded the set of reforms currently being advocated by the African High-Level Working Group on the reform of the global financial architecture.

Pedro further underscored the importance of “an inclusive international tax system to ensure the taxing rights of African countries and the need to formulate an African Position on the UN Tax Convention.” This, he said, stems from a resolution adopted by the UN General Assembly in 2022 to begin discussions on the possibility of developing an international tax cooperation framework.

“With this backing, member States will be able to begin intergovernmental discussions on ambitious reforms to the global governance structure to curb global tax abuse by multinational corporations,” he said.

“As a first step, ECA, in collaboration with the African Tax Administration Forum (ATAF), is supporting 10 African countries in estimating tax expenditures using a benchmarking methodology to examine the lost opportunities of tax revenues given as tax incentives and other perverse practices that could have been used for sustainable development,” he added.

Pedro also highlighted the need to address illicit financial flows (IFFs), which continue to siphon critical financial resources away from the continent. While progress has been made to bridge the data gap by developing harmonized methodology for estimating IFFs on the continent, he said more needs to be done on accelerating implementation.

Present at the meeting were Albert Muchanga, African Union Commissioner for Economic Development, Trade, Tourism, Industry and Minerals, Raymond Nazar, Chair Experts, Bureau of the Second Specialized Technical Committee on Finance, Monetary Affairs, Economic Planning, and Integration, Logan Wort, Executive Secretary, African Tax Administration Forum and Maurice Ochieng, Programme Manager GIZ-GFG