The flagship report of the World Bank, ‘World Development’, which focused on finance, advised that recovery from the impacts of COVID-19 requires continued access to credit to households and businesses.

Entitled, Finance for an equitable recovery, the new report released this week reviewed the economic impacts of COVID-19 pandemic at the global level and reviewed emerging risks that makes hard the recovery.

“…In response to lockdowns and mobility restrictions necessary to contain the virus, many governments supported borrowers through direct cash transfers and financial policy tools, including debt moratoria and credit guarantees. As the crisis unfolded, these policies provided much-needed support to households and small businesses and helped avert a wave of insolvencies and loan defaults, which could have threatened the stability of the financial sector. Looking ahead, ensuring that debt burdens for households and businesses are sustainable and that there is continued access to credit is essential for an equitable recovery,” the report advised.

“Similarly, governments, central banks, and regulators also used policy tools to assist financial institutions and prevent financial sector risks from spilling over to other parts of the economy. In many countries, central banks lowered interest rates, injected liquidity into the market, broadened access to refinancing facilities, and reduced provisioning requirements. These measures enabled banks and other institutions to continue to offer financing to households and businesses,” it said.

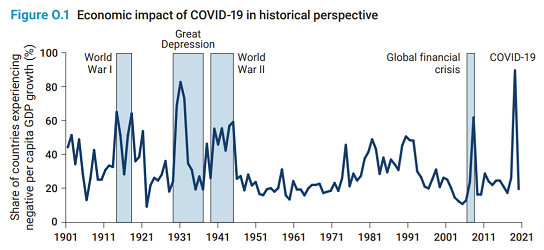

The report stated that in 2020, the first year of the COVID-19 pandemic, the global economy shrank by approximately 3 percent, and global poverty increased for the first time in a generation.

“…The risks now embedded in bank balance sheets will have to be addressed to ensure that the financial sector is well capitalized going into the recovery phase and is able to fulfill its role of providing credit to finance consumption and investment,” the report stated.

“The crisis response will also need to include policies that address the risks arising from high levels of sovereign debt to ensure that governments preserve their ability to effectively support the recovery. The support measures adopted to mitigate the immediate impact of the pandemic on households and businesses required new government spending at a time when many governments were already burdened by elevated levels of public debt.”

High debt levels reduce a government’s ability to support the recovery through direct support of households and firms, according to the report. “They also reduce a government’s ability to invest in public goods and social safety nets that can reduce the impact of economic crises on poverty and inequality. Managing and reducing high levels of sovereign debt are therefore an important condition for an equitable recovery,” stated the new report of the World Bank.

Emerging risks

The report also stated that beyond efforts to support the domestic economy, governments must also consider developments in the global economy that could pose a threat to an equitable recovery. “Connections forged through global credit markets, international trade, foreign aid, and other areas create interdependencies. These connections have noticeably affected the recovery, perhaps best illustrated by the disruption of vital global supply chains through the temporary shutdown of factories, shipping, warehouses, and other essential infrastructure.”

“One important global risk is the uneven pace of recovery between advanced and emerging economies. The faster recovery in advanced economies is likely to precipitate an increase in global interest rates, which will expose public and private sector borrowers to refinancing risks and put downward pressure

on the currencies of emerging economies.”

These risks are especially acute for low-income countries with high levels of foreign currency denominated debt, and they create a dilemma for the central banks of emerging economies, according to the report.

“If they do not follow the interest rate hikes in advanced economies, they face the risk of capital outflows and a depreciation of the national currency. However, if they raise interest rates, they risk dampening the domestic economy by exerting pressure on borrowers and increasing the cost of servicing domestic sovereign debt.”

“In view of these trade-offs, a carefully chosen policy mix that addresses interest rates, exchange rates, and macroprudential policy is crucial. This is especially important in countries with financial sectors that rely on credit and capital markets for wholesale finance because financial institutions that cannot refinance themselves will have less capacity to supply credit during the recovery. It should also be a high priority in countries where state-owned enterprises account for a significant share of the economy. When state-owned enterprises cannot refinance short-term debt or service foreign currency debt, the risk of contingent liabilities for governments is even higher,” it said.