BY YANET FANTAYE WOGAYEHU – As Ethiopia grapples with rising inflation and internal conflicts, consumers are closely watching for signs of relief following the government’s July decision to introduce a floating foreign exchange (forex) rate.

In addition to the new forex regime, attention is also on the upcoming launch of the Ethiopian Securities Exchange (ESX) later this year, a move many see as crucial for stimulating investment and economic growth. Both initiatives are part of a broader reform agenda aimed at addressing long-standing economic distortions and setting the country on a more sustainable growth trajectory.

The floating exchange rate, announced by the National Bank of Ethiopia (NBE) and welcomed by international financiers, including the International Monetary Fund (IMF), is a key pillar of the government’s economic overhaul. Under the new forex regime, the birr will no longer be pegged to a fixed rate. Instead, its value will be determined by market forces in a competitive forex system — a significant departure from previous policies.

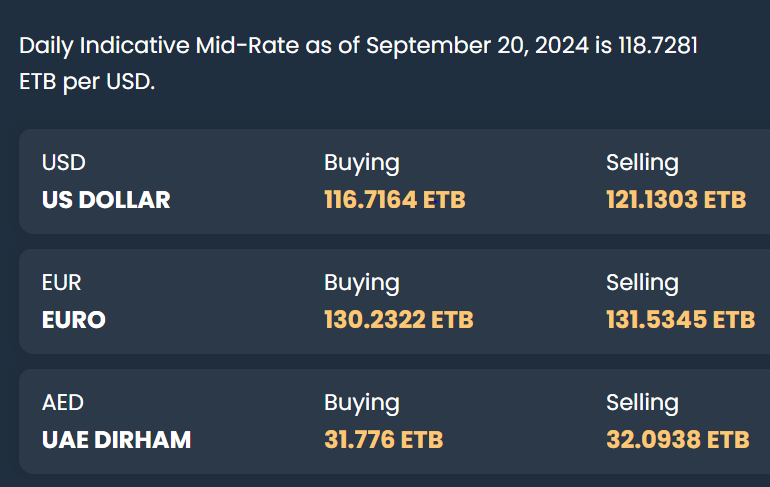

As a result of the decision, the value of one UD dollar, which was around 58 Birr has now double to around 116 Birr. The Ethiopian government argues that this transition will enhance economic resilience, create a more favorable environment for foreign investment, and ultimately alleviate the chronic shortage of foreign currency that has long hampered the nation’s economy.

A Struggling Economy and Internal Conflict

Ethiopia’s economy has faced significant challenges over the past few years. Inflation remains high, driven by global supply chain disruptions, foreign exchange shortages, and internal conflicts in regions such as Tigray, Amhara, and Oromia. These conflicts have destabilized key sectors, displaced millions, and worsened an already fragile economic situation. The shortage of foreign currency has crippled industries reliant on imports, causing rising prices for both domestic and imported goods.

NBE says the previous fixed exchange rate system only deepened these challenges. According to the central bank, the artificially high value of the birr created a significant gap between official and black market exchange rates, further fueling inflation and speculation. As conflict and instability continue to disrupt key economic regions, consumers bear rising costs.

Concerns Over Rising Prices

While the government is optimistic about the long-term benefits of the floating exchange rate, critics warn that it could exacerbate Ethiopia’s already soaring prices. Kebour Ghenna, Executive Director of the Pan African Chamber of Commerce and Industry (PACCI), voiced his concerns in social media posts. He argued that structural weaknesses and ongoing conflicts could hinder Ethiopia’s ability to manage the transition effectively.

“The success of a market-based foreign exchange rate system depends on the economic position and strength of the countries implementing it,” Kebour stated. He warned that currency fluctuations and the speculative risks of such systems often challenge nations with limited exports, vulnerable economic structures, and internal instability.

Optimism for the Future

Other experts are more optimistic about Ethiopia’s economic prospects despite these concerns. Prominent Ethiopian-American economist Zemedeneh Negatu acknowledges that “the country’s economic reform is a work-in-progress” and will face challenges such as inflation and forex liquidity, compounded by internal conflicts.

However, he insists that the current transformational economic reforms are beginning to yield visible and measurable results. Zemedeneh stresses that sustained long-term strategy and effective policy execution by both public and private sectors are essential for the reform’s success.

Adding to this optimism is Ethiopia’s planned stock market launch, expected in mid-November 2024. The Ethiopian Securities Exchange (ESX) recently closed a highly successful capital-raising exercise, securing ETB 1.51 billion ($26.6 million), more than double its initial target.

ESX said this significant achievement reflects strong domestic and international investor confidence in Ethiopia’s economic future. The ESX, established through a public-private partnership with Ethiopian Investment Holdings (EIH), aims to unlock new avenues for investment, promote corporate governance, and foster sustainable development across various sectors of the economy.

IMF Support and Economic Outlook

The IMF, which forecasts Ethiopia’s economy to grow by 6.2% this year, has welcomed the floating exchange rate as a critical component of Ethiopia’s broader economic reform program. The IMF approved a four-year financing package under the Extended Credit Facility (ECF) to support Ethiopian economic reforms, amounting to SDR 2.556 billion (approximately $3.4 billion).

IMF says its support will help Ethiopia address macroeconomic imbalances, restore external debt sustainability, and develop inclusive, private-sector-led growth. The IMF’s decision has allowed an immediate disbursement of $1 billion to help Ethiopia meet its balance of payments needs and support the national budget.

Consumers in Ethiopia are eagerly awaiting potential relief from the government’s economic reforms, including the shift to a floating exchange rate and the upcoming launch of the Ethiopian Securities Exchange (ESX). Many hope these changes will address inflationary pressures and stimulate investment, creating jobs for Ethiopia’s predominantly young population.

But at the end of the day as the saying goes, “the devil is in the detail”, it all depends on the execution of the forex liberalization, especially on how the banks implement and the central bank uses the tools at its disposal to maintain economic stability and achieve the expected outcomes that mainly benefit the majority of the Ethiopian consumers.