The profit of all the 16 private banks in Ethiopia for the first time exceed the profit of the state owned giant Commercial bank of Ethiopia during the budget year concluded June 30, 2020.

A new research paper released by a private equity firm, Cephues Invest Advisory, shows that the 16 private banks have for the first time grossed 17 billion Birr collectively, while CBE’s profit for the year stood at 14 billion Birr. “Private banks have steadily increased their market shares in branch networks, deposits, loans, and profits. For the just-ended fiscal year, the total new deposits mobilized by private banks (Birr 89 billion) exceeded that of CBE (Birr 54 billion), while private banks’ collective profits (Birr 17 billion) have now surpassed—for the first time—that of the state bank (Birr 14 billion),” the report stated.

Stating that private banks in Ethiopia were not severely impacted by the global pandemic – COVID-19, it indicated that “average returns to shareholders (EPS) were near 32 percent, not much different from the norms of recent years.” “Ethiopia’s private banks finished the 2019-20 fiscal year on a sound footing, with deposits up 25 percent, loans up 34 percent, and profits up 21 percent,” it said.

Reflecting on the outlook of the banking sector in Ethiopia, the paper noted that the sector is set to face major policy shifts as the Government modernizes its framework for deficit financing, monetary policy setting, and exchange rate determination.

“Other reforms will bring many more competitors (up to 20 new banks, MFI-turned-banks, leasing companies, fin-techs, specialized service providers, foreign financiers), broaden funding sources (via local bonds and external borrowing), and permit new services (such as capital market offerings). Taken together, these changes in the macro-financial environment will help propel continued banking sector growth but within a much more competitive environment for the established players,” the paper forecasted.

Major achievements of private banks in Ethiopia

– Private banks recorded a strong performance last year across key metrics—deposits, loans, capital, and branches.

– Loans rose by nearly Birr 100 billion for the year, funded by Birr 87 billion in new deposits and Birr 8 billion in extra capital.

– Branch networks were also significantly expanded, and the total number of private bank branches is now nearly triple that of the CBE (4,361 private bank branches vs 1,604 CBE branches).

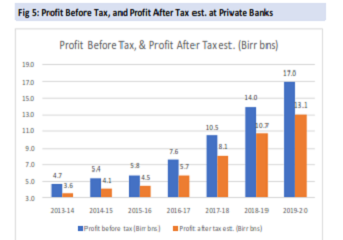

– Despite the COVID pandemic, pre-tax profits rose from 14 billion to 17 billion, though the latter are still provisional figures for June 2020. Taking into account effective tax rates for the sector, “Cephues estimates after-tax profits will be Birr 13.1 billion, implying close to Birr 4 billion in payments by private banks for the year.

– Expressed relative to year-average paid-up capital, the profit figures translate into an average Earnings per share (EPS) of 31.5 percent in FY 2019-20, close to the average returns received by shareholders over the last five years.

– Profits were equal to 2.5 percent of average assets (ROA) and also equal to 29 percent of total capital (ROE).