By Anwar Hussen Mohammed – Ethiopia, Africa’s second-most populous nation with about 120 million people, boasts a fast-growing economy. Underpinning this growth is a financial sector undergoing a period of significant change.

Let’s delve into Ethiopia’s financial landscape, exploring its current state, the challenges it faces, and the exciting opportunities on the horizon.

Current Situation:

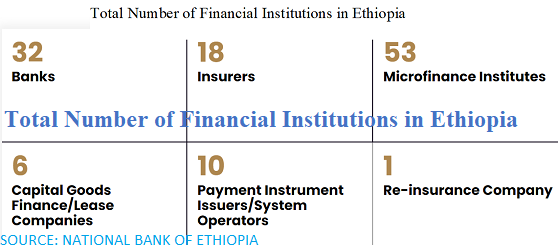

The Ethiopian financial sector is dominated by state-owned institutions, with the Commercial Bank of Ethiopia (CBE) holding a substantial market share. While this has ensured stability, limited competition has stifled innovation and access to a wider range of financial products.

However, the tide is turning. The Ethiopian government has embarked on a liberalization drive, opening up the telecom sector and setting its sights on the banking industry. This move, if implemented strategically, could usher in a new era of financial inclusion and dynamism.

Major Challenges:

Despite its growth, Ethiopia’s financial sector faces several hurdles. One major challenge is financial inclusion. A large portion of the population, particularly in rural areas, remains unbanked. Additionally, access to credit, especially for small and medium-sized enterprises (SMEs), is limited. Furthermore, the country grapples with a persistent foreign exchange (forex) shortage, hindering international trade and investment.

Recently the council of Ministers has approved a new Banking Business Proclamation, which can provide for opening up the banking sector to foreign investment; and allow foreign banks to invest in the banking business through opening foreign bank subsidiary, branch or invest in shares of existing domestic banks.

Let’s look to major benefits of this proclamation.

Benefits of Financial Sector Liberalization in Ethiopia:

• Increased Competition: Foreign banks can bring new technologies, expertise, and financial products, pushing domestic banks to innovate and improve efficiency. This can lead to better interest rates, lower fees, and a wider range of services for Ethiopian businesses and individuals.

• Increased Investment: Foreign banks may attract foreign capital into Ethiopia, which can be used to finance infrastructure projects, business ventures, and overall economic growth.

• Improved Financial Depth: A more developed financial sector with diverse players can lead to a more robust and stable financial system, attracting more domestic savings and making it easier for businesses to access credit.

Expected Drawbacks:

• Challenges for Domestic Banks: Less established domestic banks might struggle to compete with larger, foreign institutions. Mergers and acquisitions could occur, potentially reducing competition in the long run.

• Loss of Control: The Ethiopian government might have less control over the financial sector with foreign involvement. This could be a concern if the government wants to direct credit towards specific sectors.

• Job Losses: Job losses could occur in the banking sector if foreign banks bring in their own staff or automate processes currently done manually. In addition, mergers of small local banks can also result in job losses.

Forex Shortage and Banking Liberalization:

Financial sector liberalization alone might not solve the entire forex shortage issue. However, it could help in a few ways:

• Increased Foreign Investment: As mentioned above, attracting foreign capital can improve forex reserves.

• Improved Efficiency: A more efficient financial sector could lead to better management of foreign currency exchange.

Impact on Exchange Rate Gap:

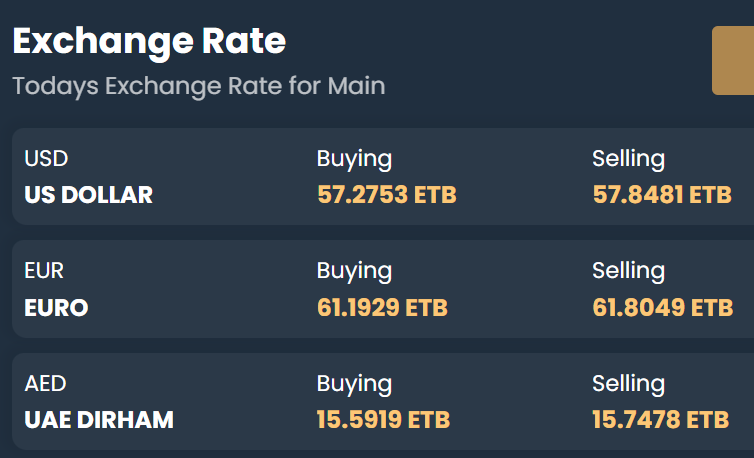

Liberalization could initially widen the black market (which is now between 116 to 120 Birr for one US dollar) and the official exchange rate gap (which is less than 58 for one US dollar). This could happen if:

• Increased Demand for Forex: Foreign banks might create a higher demand for forex, putting pressure on the official rate.

• Limited Access to Foreign Currency: If access to forex through official channels remains limited, businesses might turn to the black market.

Impact on Cost of Living and Inflation:

The impact on cost of living and inflation is complex.

• Increased Investment: Increased investment due to liberalization could boost economic activity, potentially leading to job creation and higher incomes, offsetting some inflation.

• Higher Interest Rates: More competition might lead to higher interest rates for borrowers, which could raise the cost of doing business and impact consumer spending.

The overall impact on inflation will depend on how the government manages the financial sector after liberalization. Financial sector liberalization in Ethiopia has both potential benefits and drawbacks. Careful planning and implementation are crucial to maximize the benefits and minimize the risks.

Opportunities Abound:

Despite the challenges, Ethiopia presents a wealth of opportunities. The large and growing population offers a vast potential customer base for financial institutions. The government’s commitment to financial inclusion, coupled with the liberalization drive, paves the way for innovative financial products and mobile money solutions to reach the unbanked. Foreign banks entering the market can inject much-needed capital and expertise, fostering competition and propelling the sector forward.

The Road Ahead:

Ethiopia’s financial sector stands at a crossroads. Navigating the path to a more robust and inclusive system requires careful planning. The government must ensure a smooth transition for domestic banks while fostering a competitive environment that attracts foreign investment. Developing a robust regulatory framework and prioritizing financial literacy will be crucial. By addressing these challenges and capitalizing on the opportunities, Ethiopia can unlock the full potential of its financial sector, propelling its economic growth and social development in the years to come.