Compared to the proceeding budget year, Earnings per share of Oromia International Bank (OIB), one of the private banks in Ethiopia, has dropped by 29 percent to 374 birr (about $ 11.8 at the currency exchange rate) for par value of 1,000 birr (about $31.5) during the budget year concluded June 30, 2019.

Meanwhile average dividend per share has increased by 11 percent to 307 birr (about $9.7), according to the annual report of the Bank, which held its shareholders annual general assembly last week. Gross profit of OIB has only increased modestly by 7 percent to 1 billion birr (about $31.45 million), while the net profit of the Bank has grown slightly by 2 percent to 740 million birr (about $23.3 million). OIB has paid 261.3 million birr (about $8.2 million) income tax to the government of Ethiopia.

On the other hand, the expenses of the Bank has increased by 46 percent to 2.2 billion birr (close to $69.2 million), according to the report. The revenue of OIB has also increased by 31 percent to 3.2 billion birr (about $100.63 million) during the budget year concluded June 2019.

The report also shows that the total asset of the Bank has increased by 34 percent to 31.8 billion birr (about $1 billion) compared to the previous budget year. The deposit balance of OIB has also grown up to 26.6 billion birr (about $836.5 million) showing an increase of 33 percent from the preceding budget year.

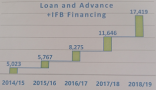

Compared to the previous budget year, paid up capital and total capital of OIB has also by 49 percent and 43 percent to 2.4 billion birr (about $75.5 million) and 3.7 billion birr (about $116.4 million), respectively during the budget year ended June 30, 2019. The report also shows that the number of borrowers has also increased by 20 percent reaching 10,262 during the budget year concluded June 30, 2019.

The report also shows that Oromia International Bank, which has a total of 5,212 of employees, has managed to increase its number of branches by 7 percent to 265 during the budget year concluded June 30, 2019.