The Government of Ethiopia today announced liberalization of the forex market, which immediately resulted in about 31 percent devaluation of the country’s currency – Birr against major currencies.

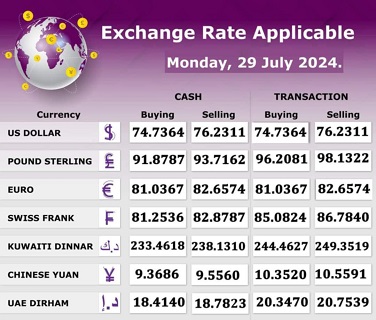

Following today’s implementation of the new directive that liberalized the forex market of the country, the value of one UD dollar, which was equivalent to around 57 Birr in commercial banks such as Commercial Bank of Ethiopia, has immediately increased to 75 Bir.

The decision is made following years of negotiations between the International Monetary Fund (IMF) and the Government of Ethiopia. As a result, IMF is expected to release a few billions of dollars in the first round to help Ethiopia make available forex for the basic commodities import, among others.

Reports show that the forex reserve of Ethiopia has been depleting that has resulted and led to the widening gap between the formal forex exchange and the black-market.

The value of one US dollar in black market was between 115 to 120 Birr until today’s government decision. As a result, most of the remittances has been going through the black-market channel worsening the forex shortage in Ethiopia. Most importers have also been using the black market or have been paying double the formal market by bribing bank managers to secure forex.

The latest decision of the government is expected to narrow that gap between the black-market and formal exchange rate in the long run. Likewise, if the government has not been able to make available enough forex to the banks, the current value of Birr is expected to depreciate further, while simultaneously the gap between the formal and the black-market is also expected to continue widening, according to experts.

The National Bank of Ethiopia (NBE), the state agency which regulates the financial system of the country, stated in a press statement today that the foreign exchange reforms being announced today involve significant new policy changes in the following areas:

1. A shift to a market-based exchange regime, whereby banks are henceforth allowed to buy and sell foreign currencies from/to their clients and among themselves at freely negotiated rates, and with the NBE making only limited interventions to support the market in its early days and if justified by disorderly market conditions.

2. The end of surrender requirements to the NBE, allowing foreign exchange to be retained by exporters and commercial banks and thus substantially boosting FX supplies to the private sector.

3. The removal of import restrictions that previously prohibited 38 product categories and the broader liberalization of the foreign exchange market for the imports of goods and services, while capital account outflows remain restricted as before.

4. The improvement of retention rules allowing exporters to retain 50 percent of their foreign exchange proceeds vs 40 percent previously.

5. The complete removal of rules governing banks’ allocation of foreign exchange that was based on a waiting list system for different categories of imports.

6. The introduction of non-bank foreign exchange bureaus that are henceforth free to engage in the buying and selling of foreign currency cash notes at market rates.

7. The removal of restrictions on franco valuta imports, to be implemented shortly through an upcoming regulation.

8. The simplification of rules governing foreign currency accounts, especially those

currently held by foreign institutions, FDI companies, and the Diaspora.

9. The allowance for residents to open foreign currency accounts, based on remittance inflows, transfers from abroad, FX-based salary or rental income, and for other specified cases, as well as the ability to use such foreign currency accounts for foreign service payments.

10. The removal of interest rate ceilings that previously applied to private sector companies or banks when borrowing from abroad.

11. The opening of Ethiopia’s securities market to foreign investors, with the terms and conditions to be specified further in the near future.

12. The granting of special foreign exchange privileges to companies within Special Economic Zones, including the ability to retain 100 percent of their foreign exchange earnings.

13. The relaxation of various rules on the amount of foreign currency cash notes travelers

may carry when travelling into or out of Ethiopia.

“The reform in the exchange rate system being introduced today is challenging in several respects but at the same time critically necessary. The prevailing foreign exchange rate system, though initially meant to help ensure a stable exchange rate and low inflation, has instead resulted in the emergence of an unanchored parallel market exchange rate together with high inflation,” stated NBE.

“The current system has given rise to large-scale contraband exports of Ethiopia’s precious resources and diverted the country’s foreign exchange earnings away from both the formal banking system and the domestic economy. All of this has improperly benefitted a few illegal actors and middlemen at the expense of Ethiopia’s productive sectors, which face chronic and acute foreign exchange shortages. Some of Ethiopia’s most dynamic businesses and entrepreneurs have thus suffered significantly as a result, undermining policy efforts to expand exports, boost manufacturing, attract further foreign investment, and establish a stronger FX position,” NBE said trying to justify the government move of liberalizing the forex market.

It was in September 2010 that the Government of Ethiopia has taken a major devaluation by reducing the value of Birr by 16.7 percent against the major currencies.