Credit to micro and small enterprises in Ethiopia has declined by 34 percent during the last budget year of Ethiopia 2020/21 to 5 billion Birr compared to the preceding budget year.

As a result, over 984,000 jobs in MSEs have vanished, according to the annual report of the National Bank of Ethiopia (NBE) released this month (March 2022). Compared to the 7.67 billion Birr loans micro and small enterprises (MSEs) have received in 2019/20, the amount of credit accessed by the MSEs has declined by 2.65 billion Birr,

The total number of micro and small enterprises operating in Ethiopia in 2020/21 has increased to 115,200 from 111,547, according to the report. Even though the number of Micro and small enterprises (MSEs) has increased during the budget 2020/21, close to one million people (984,044) who were working in the MSEs have lost their jobs.

The total number of employments by MSEs, which was 1,569,163 in 2019/20, has dropped to 585,119 in 2020/21 (Ethiopian budget year began July 8, 2020), according to according to the annual report of the state agency NBE, which didn’t explain the reason.

On the contrary, during the 2020/21 budget year the 29 microfinance institutions (MFIs) in Ethiopia, whose main clients are MSEs, have grown their total capital and total asset by 43.4 and 13.8 percent and stood at Birr 27.9 billion and Birr 105 billion, respectively compared to the previous year.

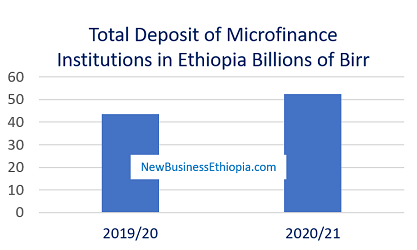

“… MFIs’ deposit mobilization and credit expanded remarkably. Compared to last year, their deposit increased 17.2 percent to Birr 52.4 billion while their outstanding credit rose 6.7 percent to Birr 69.3 billion,” the annual report stated.

The five largest MFIs, namely, Amhara, Dedebit, Oromia, Omo, and Addis Credit and Savings Institutions accounted for 84.8 percent of the total capital, 88.8 percent of total deposit, 82.7 percent of total credit and 84.3 percent of total assets of MFIs by the end of 2020/21.

Out of the total 115,000 MSEs that were found in Ethiopia in 2020/21, 39.9 percent were located in Oromia followed by Amhara (34.5 percent), SNNPR (7.2 percent), Addis Ababa (6.7 percent), Sidama (6.5 percent) and Somali (3 percent) regional states.

“With respect to total loans, SMEs in Amhara received 34 percent, Addis Ababa 25.7 percent, Oromia 22 percent, SNNPR 11.7 percent, Sidama and Dire Dawa 2.4 percent each. Of the total jobs created by these enterprises, 49.4 percent was in Oromia, 20.8 percent in Amhara, 11.3 percent in SNNPR, 6.4 percent in Sidama, 6.1 percent in Addis Ababa and 2.8 percent in Somali region,” the report stated.