Climate financing by the world’s six largest multilateral development banks (MDBs) rose to a seven-year high of US$ 35.2 billion in 2017, up 28% on the previous year, says new report.

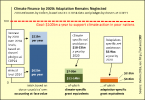

The MDBs’ latest joint report on climate financing said US$ 27.9 billion, or 79% of the 2017 total, was devoted to climate mitigation projects that aim to reduce harmful emissions and slow down global warming.

The remaining 21%, or US$ 7.4 billion, of financing for emerging and developing nations was invested in climate adaptation projects that help economies deal with the effects of climate change such as unusual levels of rain, worsening droughts and extreme weather events.

In 2016 climate financing from the MDBs had totalled US$ 27.4 billion.

The latest MDB climate finance figures are detailed in the 2017 Joint Report on Multilateral Development Banks’ Climate Finance, combining data from the African Development Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, the European Investment Bank, the Inter-American Development Bank Group and the World Bank Group (World Bank, IFC and MIGA).

These banks account for the vast majority of multilateral development finance. In October 2017 the Islamic Development Bank joined the MDB climate finance tracking groups, and its climate finance figures will be included in joint reports from 2018 onwards.

Climate funds such as the Climate Investment Funds (CIF), the Global Environment Facility (GEF) Trust Fund, the Global Energy Efficiency and Renewable Energy Fund (GEEREF), the European Union’s funds for Climate Action, the Green Climate Fund (GCF) and others have also played an important role in boosting MDB climate finance. As well as the US$ 35.2 billion of multilateral development finance, the same adaptation and mitigation projects attracted an additional US$ 51.7 billion from other sources of financing last year.

Of the 2017 total, 81 per cent was provided as loans. Other types of financial instruments included policy-based lending, grants, guarantees, equity and lines of credit.

Latin America, Sub-Saharan Africa and East Asia and the Pacific were the three major developing regions receiving the funds. The report contains a breakdown of climate finance by country.

The sharp increase came in response to the ever more pressing challenge of climate change. Calls to galvanise climate finance were at the heart of events such as the One Planet Summit in Paris in December 2017, two years after the historic Paris Agreement was adopted. Multilateral banks began publishing their climate investment in developing countries and emerging economies jointly in 2011, and in 2015 MDBs and the International Development Finance Club agreed joint principles for tracking climate adaptation and mitigation finance.

Climate finance addresses the specific financial flows for climate change mitigation and adaptation activities. These activities contribute to make MDB finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development, in line with the Paris Agreement. The MDBs are currently working on the development of more specific approaches to reporting their activities and how they are aligned with the objectives of the Paris Agreement.

Anthony Nyong, Director for Climate Change and Green Growth at the African Development Bank said: “The increasing level of total MDB climate finance flowing to developing countries is encouraging. African Development Bank’s climate finance grew from 9% in 2016 to 28% in 2017 and on track to meet the 40% commitment by 2020. However, Africa continues to receive only 3% of global climate finance, which does not match the level of ambition put forward in the NDCs of many African countries. Global advocacy and action is necessary to avail requisite climate finance and technology necessary to deliver the goals of the Paris Agreement”.