Buffeted by an unprecedented series of shocks, the global economy has shown extraordinary resilience so far.

Global inflation appears to be waning, and most economies have been performing better than they were expected to only a few months ago. Seldom in history has a global inflationary spiral been halted with so little pain.

That’s the good news—or so it might seem. What is going largely unnoticed, however, is the plight of the 75 poorest and most vulnerable economies—the ones eligible for grants and low-interest loans from the World Bank’s International Development Association (IDA). These economies are home to a quarter of humanity—and they’re in the midst of a historic economic reversal even as the near-term outlook brightens elsewhere.

In addition to being a human concern, that’s bad news for the global economy—both because long-term global growth will depend a lot on what happens in these economies, and because deepening pain here could spread beyond national borders.

The combination of pre-pandemic vulnerabilities, recent overlapping crises, and wider problems—including the effects of climate change and increases in violence and conflict—is weighing heavily on IDA countries: by the end of 2024, they are expected to have experienced the weakest half-decade of growth since the early 1990s.

One in three IDA countries is poorer today than it was on the eve of the pandemic. Between 2020 and 2024, income convergence relative to advanced economies has essentially stalled, and half of IDA countries are expected to grow more slowly in per capita terms than advanced economies over this period.

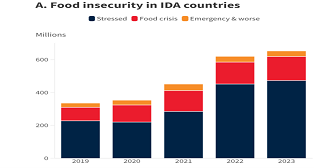

Extreme-poverty rates in these countries are eight times the rate in the rest of the world, and the number of people facing hunger or malnutrition has doubled since 2019—to 651 million (Figure 3). That is 92 percent of the global total of people facing food insecurity.

In addition, half of these countries are either in debt distress, or at high risk of it. While several major economies are seeing growth surprise on the upside, near-term projections for IDA countries are, on average, being revised down.

A tough external environment magnifies the challenges facing IDA countries. Conflict and episodes of violence are rising in frequency, undermining stability in these countries. Their investment needs are rising—particularly to address climate change, to which many of these economies are especially vulnerable. In this environment, a major risk is that stagnation becomes entrenched for the longer term.

Yet there are reasons for optimism. Since 1960, 36 countries have successfully graduated from IDA—including some of the world’s largest economies such as China, India, and Korea. Current IDA countries also have great potential, starting first with people: working-age populations in these countries are expected to grow markedly over the next five decades, while they decline in advanced economies and in other developing economies.

Many IDA countries also have significant natural resource endowments, including some that will be essential for the energy transition. From solar potential to critical minerals, IDA economies hold some substantial comparative advantages.

Of course, successfully realizing demographic dividends and harnessing natural resource advantages is not an easy task. There are clear risks, and cautionary tales abound. Managing natural resources requires robust institutional and regulatory frameworks. Providing high-quality healthcare and education is vital for taking advantage of favorable demographics.

Ultimately, greater investment will be the key ingredient for these countries to unlock their potential, address growing challenges like climate change, and move towards a sustainably brighter future. Investment growth in IDA countries has generally been weak in recent years. Both public and private investment are required, and the quality of investment matters. Implementation of comprehensive policy reform packages has been shown to increase the likelihood of an extended period of strong investment growth.

There is no one-size-fits-all solution for triggering an investment acceleration. Effective policy packages often include measures to durably improve fiscal and external imbalances, secure macroeconomic stability, and advance an array of structural reforms—including to strengthen institutions, better manage natural resources, boost human capital, enhance gender equality and youth inclusion, and combat climate change.

For many IDA countries, fostering stability is also an important contributing factor. The sequencing of policy interventions is a pivotal consideration and depends on country circumstances. Despite difficult circumstances, however, these countries have strong agency and can advance many of these objectives.

The global community also has an important role to play. Against a backdrop of historically challenging international and domestic circumstances, IDA countries’ policy efforts— should be complemented by significant and consistent international financing. If IDA countries can effectively harness their strong demographic profiles and their resource wealth, this would not only support their own development; it would also advance global objectives.

To create an environment in which IDA countries can thrive, enhanced international cooperation on global issues will also be necessary. International progress to tackle climate change, promote rules-based international trade, ensure more timely and effective sovereign debt restructuring processes, and address mounting food insecurity and conflict is critical.

Progress across all of these areas is essential for giving IDA economies the best chance of a brighter future—and progress in IDA countries is imperative if the world is to have a reasonable chance of securing long-term peace and prosperity.