In their joint brief paper, Era Dabla-Norris, Vitor Gaspar, and Marcos Poplawski-Ribeiro stated that major policy shifts underway have heightened global uncertainty and indicated that global public debt is likely to continue posing major challenge to countries.

Amid heightened uncertainty, policymakers will need to deal with complex trade-offs between debt, slower growth, and new spending pressures, say experts at the International Monetary Fund (IMF). Below is their full commentary published on Wednesday:

“The series of recent tariff announcements by the United States, and countermeasures by other countries have increased financial market volatility, weakened growth prospects, and increased risks. They come in the context of rising debt levels in many countries and already strained public finances, which in many cases will also need to accommodate new and permanent increases in spending, such as defense. Rising yields in major economies and widening spreads in emerging markets further complicate the fiscal landscape.

We project global public debt to increase by 2.8 percentage points this year—more than twice the estimates for 2024—pushing debt levels above 95 percent of gross domestic product. This upward trend is likely to continue, with public debt nearing 100 percent of GDP by the end of the decade, surpassing pandemic levels. These numbers are based on the World Economic Outlook reference projections, reflecting tariff announcements made between Feb. 1 and April 4. Amid substantial policy uncertainty and a shifting economic landscape, debt levels could rise even further.

In this environment, fiscal policy faces critical trade-offs: balancing debt reduction, building buffers against uncertainties, and meeting urgent spending needs amid weaker growth prospects and higher financing costs. Navigating these complexities will be essential for fostering stability and growth.

Risk of higher debt Debt risks were already elevated. According to the Fiscal Monitor’s debt-at-risk,

which utilizes data up to December 2024, in a severely adverse scenario global public debt could reach 117 percent of GDP by 2027. This would represent the highest level since World War II, exceeding reference projections by almost 20 percentage points.

Risks to the fiscal outlook have further intensified. Debt levels may rise even further than the debt-at-risk estimates if revenues and economic output decline more significantly than current forecasts due to increased tariffs and weakened growth prospects.

Additionally, escalating geoeconomic uncertainties could heighten debt risks, driving up public debt through increased expenditures, particularly in defense. Demands for fiscal support could also rise for those vulnerable to severe disruptions from trade shocks, pushing up spending. The Fiscal Monitor estimates that a significant rise in geoeconomic uncertainty could lead to a public debt increase of approximately 4.5 percent of GDP in the medium term.

Tighter and more volatile financial conditions in the United States may have ripple effects on emerging markets and developing economies, leading to higher financing costs. This significantly impacts commodity prices, resulting in lower prices and heightened price volatility.

Limited fiscal improvements may further heighten risks from rising interest rates, especially as many countries have substantial financing needs. High interest rates could limit essential spending on social programs and public investments. Additionally, reduced foreign aid, due to shifting priorities among advanced economies complicates financing for low-income countries.

Complex policy tradeoffs

In an uncertain and rapidly changing world, countries will need to first and foremost put their own fiscal house in order. This means implementing prudent policies within robust fiscal frameworks to build public confidence and help reduce uncertainty.

Fiscal policy should prioritize reducing public debt and establishing and widening buffers to address spending pressures and economic shocks. This means finding the right balance between adjustment and supporting economic growth, tailored to each country’s unique situation, available resources, and overall economic conditions.

Countries with limited room in government budgets should implement gradual and credible consolidation plans and allow automatic stabilizers, like unemployment benefits, to work effectively. Any new spending needs should be offset by spending cuts elsewhere or new revenues. For countries with greater fiscal flexibility, it is important to utilize available resources judiciously within well-defined medium-term plans.

Fiscal support for businesses and communities impacted by severe trade dislocations should be both temporary and targeted, with a strong emphasis on transparency and effective cost management.

More generally, advanced economies should tackle issues related to aging populations by reprioritizing spending, advancing pension and healthcare reforms, and broadening the tax base. In emerging and developing economies, enhancing the tax system is crucial due to historically low revenues.

Low-income developing countries should stay the course on fiscal adjustments given financing challenges. Timely and orderly debt restructuring alongside such adjustments is essential for countries

facing debt distress.

Additionally, fiscal policy, alongside other structural policies, should focus on enhancing potential growth. This can help ease challenging tradeoffs between growth and debt sustainability. For instance, well-designed pensions and energy subsidy reforms can generate savings that can be used to support social programs and infrastructure investments.

As significant policy changes and heightened uncertainty reshape the global economic landscape, the fiscal outlook has worsened. To effectively navigate these challenges, governments should focus on building public trust, ensuring fair taxation, and managing resources wisely. By doing so, they can foster resilience and promote sustainable growth in uncertain times.”

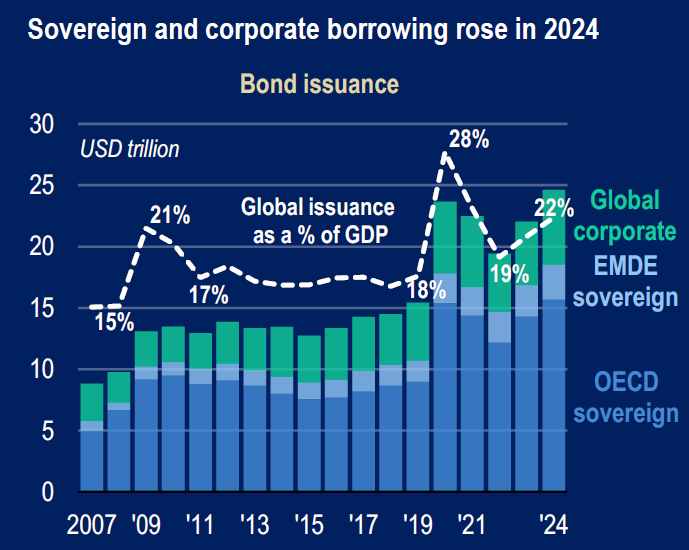

According to last month report by the Organization for Economic Co-operation and Development (OECD), sovereign bond issuance in OECD countries is projected to reach a record USD 17 trillion in 2025, up from USD 14 trillion in 2023.

Governments and companies borrowed USD 25 trillion globally from markets in 2024, nearly triple the amount in 2007. This increase is largely the legacy of the 2008 global financial crisis and the COVID-19 pandemic, in response to which large fiscal support packages, mainly funded via debt markets, helped avoid deeper recessions. Stricter banking rules and regulations to promote the use of market-based financing have also encouraged companies to rely more on bond markets. In 2024, sovereign and corporate bond debt together exceeded USD 100 trillion globally.

“Emerging markets and developing economies’ (EMDE) borrowing from debt markets has also grown significantly, from around USD 1 trillion in 2007 to over USD 3 trillion in 2024. The outstanding global stock of corporate bond debt reached USD 35 trillion at the end of 2024, resuming a long-term trend of over two decades of consecutive increases in indebtedness that came to a temporary halt in 2022,” stated March 2025 OECD Global Debt Report.

the IMF and the World Bank Group are holding their annual Spring Meetings in Washington DC this week starting on Monday April 21, 2025.