A new report released today finds that Ethiopia’s bondholders would still make 30% profit from the government’s proposed debt restructuring deal.

The briefing also concludes that IMF debt sustainability targets could only be met if bilateral creditors accepted being repaid significantly less than bondholders. The report by The Horn Economic and Social Policy Institute (HESPI), African Forum and Network on Debt and Development (AFRODAD) and Debt Justice analyses the Ethiopian government proposal rejected by bondholders in October 2024.

The briefing finds that the highest interest rates previously paid on the bonds, and the low price the bonds have been trading at, means that bondholders would still make profit if they accepted the deal, compared to if they had lent to the US government instead. Bondholders who bought bonds when they were first issued would make 24% profit, those who bought bonds more recently would make 38% profit. This assumes the restructured debt is paid in full and on time.

“The Common Framework is creditor-centric favoring creditor interests while forcing countries like Ethiopia to take decisions to divert their resources from social protection and public services without real consideration of their human and socio-economic rights. The Common Framework must be replaced with a fair and effective sovereign debt restructuring mechanism that ensures participating countries are not compromising development obligations to their citizens and effectively denying them their socio-economic rights,” said Catherine Mithia, Policy and Partnerships Assistant at AFRODAD.

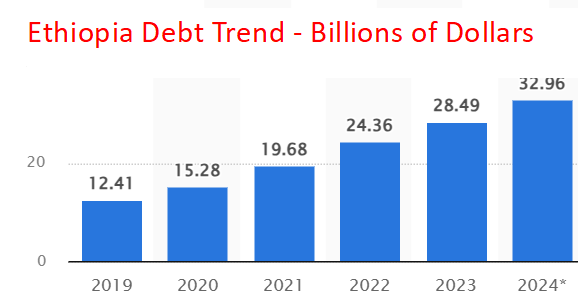

Abdurahman Hussien from HESPI said: “Mounting debt servicing has taken a toll on important social and economic sectors by crowding out limited resources. Public debt accounts for a larger share of the budget allocation than that of education, health, water and energy combined in 2022/23 & 2023/24. Substantial debt relief is required to free-up resources to finance health, education and social safety nets.”

The briefing finds that if the proposal to bondholders was accepted, Ethiopia would only be able to make small interest payments to bilateral creditors between 2025 and 2030, and no principal payments, to comply with IMF debt sustainability targets. Bilateral creditors would therefore have to accept being repaid significantly less than bondholders. The research estimates that a bilateral deal consistent with IMF targets would mean bondholders would be repaid 20% more than bilateral creditors.

“Bondholders rejected an extremely generous deal. It allowed them to still make a profit and required bilateral creditors to be repaid significantly less for debt sustainability targets to be met. Creditor governments need to do far more to make private lenders participate in debt relief, including passing laws in the UK and New York so that hedge funds, banks and asset managers cannot hold out from fair levels of debt relief,” said Tim Jones, Policy Director at Debt Justice.

HESPI is a regional think-tank doing research and advocacy on socio-economic topics pertaining to the Horn of Africa region.

AFRODAD is a Pan-African Civil Society organization that champions for responsible borrowing and lending; increased public participation in debt governance; and equalization of power between creditor and debtor country governments in Africa.

Debt Justice (formerly Jubilee Debt Campaign) is a UK charity working to end poverty caused by unjust debt through education, research and campaigning.