By Muluneh Gebre – Ethiopia’s macro-economic performance remains positive amid severe inflation, drought and clashes in different parts of the country, a senior Ethiopian economist has said.

Adem Feto (PHD), a researcher at the Ethiopian Economic Association, says Ethiopia, one of Africa’s fastest-growing economies, is experiencing critical shortage of foreign currency reserve and one of the highest inflations, which has gone worsening due to conflicts in Tigray and now ongoing fighting in Amhara region.

“The situation has put the government at cross-road to formulate policies due to fluctuating economic situations,” said the economist, noting that firms are forced to cut production owing to shortage of inputs and unpredictable situations,” said Adem.

Africa’s second-most populous country with about 120 million people — had been regarded by development economists as a success story, albeit one engineered by an authoritarian government. “The Ethiopian economy has been reviving from impacts of COVID-19 pandemic and war in the Tigray region until another round of conflict broke out in the Amhara region.

“The current inflation rate, which stands at more than 30 percent, is causing macro-economic imbalance, affecting government’s ability to pay debts, worsening foreign currency shortages and hindering pro-poor projects in the country,” Adem said.

According to the economist, Ethiopia is among ten countries facing high inflation and the situation has left low income earning communities and pensioners to miss their daily bread.

Ethiopia faces galloping inflation with non-food inflation contributing more due to high excise tax, bans on some imported items and rise in fuel price.

The high inflation has weakened the purchasing power of Ethiopian birr and squeezed the volume and items consumers can buy, the researcher noted, adding the situation is driving pensioners, fixed and low-income earners into abject poverty.

The agricultural sector, which is the backbone of the Ethiopian economy, is dominated by smallholder farming systems and thus led to low production as much as 40 quintals of grain per hectare while the modern farming system yields up to 100 quintals per hectare, according to the researcher.

Ethiopia sees little increase in the national budget this year as part of the government’s strategy to contain inflation while the government slashes expenditure, suspends employment and enacts policies such as Franco Valuta, a system where traders would make hard currency.

The economist has linked the rise in the price of commodities to disruption of imports of fertilizer due to the Russia-Ukraine conflict that resulted in rise in the prices of wheat and other grains in the local market.

According to the economist, the increase in the price of fuel at the international market has also exacerbated the dwindling foreign currency reserve at the National Bank of Ethiopia – also contributing negatively to imported inflation and debt burden.

The government paid out debt accounting to 28 percent last budget year, the economist said Adem appreciating the government for paying the debt which otherwise could have been spent for pro-poor projects and advance the agriculture sector.

The economic situation also pushed businesses to cease or cut operations and production due to lack of inputs and falling financial capacity to afford them. The researcher claimed that the debt burden has indirectly contributed to the rising inflation in the country as the government has been printing and injecting money into the market.

“The government should look into how it can effectively implement its “Money Supply Policy” to ensure that the amount of money in the market is equivalent to the growth of the economy, otherwise there will be excess money in the market to worsen inflationary situations.

Macro-economic performance

The Ethiopian economy has suffered from multiple challenges, the major ones being COVID-19 and the war in different parts of the country, drought and hunger due to consecutive failed rains.

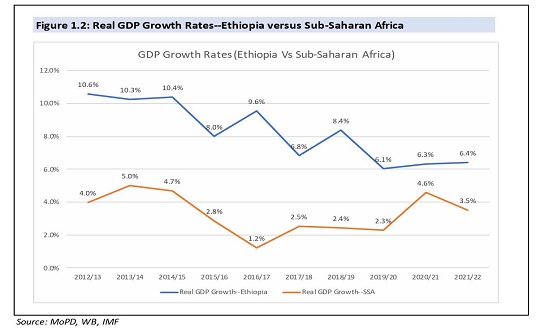

The economist claims that despite all these challenges, the Ethiopian economy has seen positive growth at the rate of more than 7.0 and according to the government data Ethiopia’s economy has reported a 7.5 percent economic growth in the last Ethiopian budget year. The government anticipates the country’s economy will grow at more than 7.9 percent this year which began on July 8, 2023.

“It looks tricky that the country is registering growth while citizens cannot get a meal in a day. This is because the economic growth is computed based on the country’s Growth Domestic Product (GDP) involving agricultural production, manufacturing of goods, services, export, construction of roads, health facilities, schools etc in a given period of time,” Adem said.

“The economic growth does not show the quantity of products and how they are fairly distributed to the public,” he added.

The banking sector is performing well and the number of banks is on the rise even though there is a liquidity problem (shortage of cash) in private banks except in those banks that are reporting profit.

Investment

Investment has declined over the past couple of years. According to the economist, the conflicts that have occurred in different parts of the country have severely affected government spending and private investments and Foreign Direct Investment (FDI).

He said that the capital budget approved by the parliament for state run investments is less than the previous capital budget one and it is unlikely the government would undertake investments this Ethiopian fiscal year.

Budget Deficit and Debt

Ethiopia’s current budget deficit accounts for less than 4 percent of the GDP, said the economist, noting that the deficit has not gone out of control. The debt burden to GDP ratio stands at 60 percent and remains to be one of the highest in Africa, Adem said.

“The government is committed to pay debt from the annual budget and the debt burden still is not out of control,” he reiterated.

Solutions

The senior economist recommended addressing the macroeconomic imbalance which he referred to as a “structural problem.”

“The government needs to prioritize addressing low foreign currency reserves and exchange rates as well as inflation problems which stand tall among the factors contributing to the macroeconomic imbalance in Ethiopia’” he says.

The government should also maximize its export both in volume and type of items, reduce import, cut employment rate, make policy reform, liberalize the banking and telecom sectors, address corruption and improve ease of doing business.

The incumbent must also resolve security challenges through peace talks and dialogue to maximize agricultural production and help factories including cement and food factories restart operations through making the necessary inputs available to them.