By Melkamu L. Atnafu-With a population of around 120 million, Ethiopia has a sizable domestic market and is the second-most populated nation in Africa behind Nigeria. The Ethiopian macro economy is currently in a difficult war-time position, facing enormous humanitarian and security costs as well as a heavy toll in terms of lost social and physical infrastructure.

This is due to an intense period of COVID-19 pandemic and a protracted and devastating civil conflict. However, conditions seem to be developing for the economy to potentially shift from a conflict mode and towards recovery and reconstruction as 2023 approaches.

Ethiopia’s economy had experienced some of the world’s fastest growth in the 15 years leading up to 2019 with an average annual growth rate of 9.5%. Growth was driven, among other things, by capital accumulation, particularly through investments in public infrastructure.

Due to COVID-19, Ethiopia’s real gross domestic product (GDP) growth dropped to 6.3% in FY2020/21 from its historically high growth rate, with growth in industry and services slowing to single digits. According to the World Bank, however, the epidemic had little impact on agriculture.

Reform

With extensive policy reforms, the corporate environment is undergoing major changes. Leading state-owned businesses are being privatized as part of a move toward market-based reforms and increased freedom in the formulation of economic policy by the government.

While Ethiopia’s economy is still expanding, if slowly, and offers opportunities, there are also barriers to conducting business there. Through an inter-ministerial group headed by the Prime Minister, the current administration is committed to enhancing the ease of doing business in the nation. The Ethiopian Investment Commission and the government work together to monitor the progress (EIC).

The Home-Grown Economic Reform Agenda, a new economic strategy unveiled by the Ethiopian government in September 2019, aims to address macroeconomic imbalances and establish the groundwork for inclusive and sustainable growth.

The reform intends to change Ethiopia’s economy from one that is dominated by the public sector to one that is propelled by the private sector. The IMF approved a nearly $3 billion program for Ethiopia in December 2019 to assist the Home-Grown Reform, which according to government sources will need an additional $10 billion in funding.

Ethiopia has a widening trade deficit, with total imports rising by 12.5% annually on average during the last 10 years. Imports, which increased from $4.8 billion in 2010 to $14.4 billion in 2015, when Ethiopia’s trade deficit peaked, were the main cause of the widening trade deficit.

International trade of goods

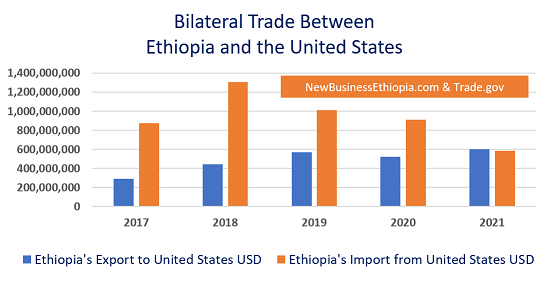

According to the National Bank of Ethiopia’s annual report, capital goods accounted for 27.2% ($3.9 billion) of the total import expenditures while consumer goods accounted for 38.3% ($5.4 billion). In 2020, the U.S. sold items worth $590 million to Ethiopia, a 35% drop from the prior year, making up 3.4% of Ethiopia’s total imports.

Ethiopia’s imports from the United States increased rapidly over the past decade, almost increasing by five times from 2007 to 2020, notwithstanding the decline from 2019 to 2020. 2021 will see a further decline in American exports to Ethiopia, but an increase in American imports from Ethiopia.

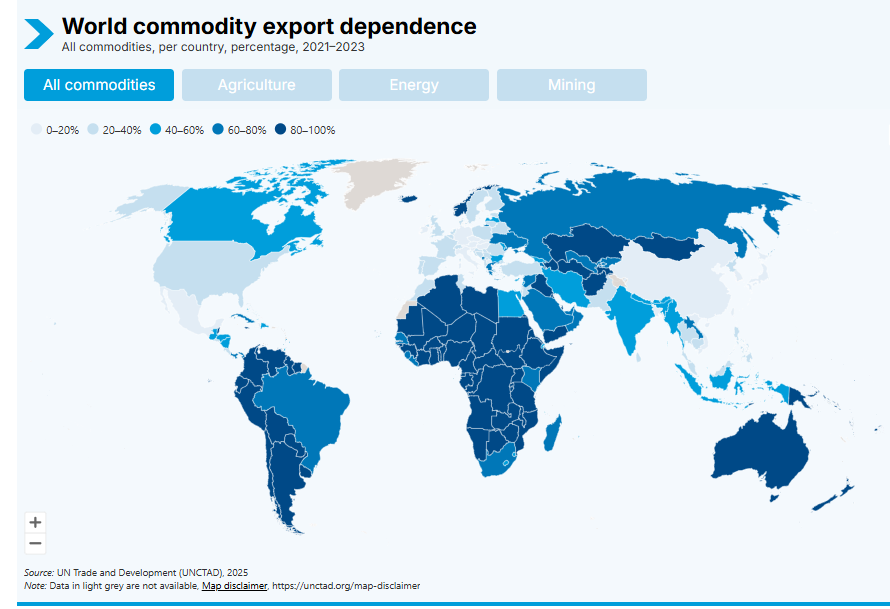

Coffee (25.1%), gold (18.6%), cut flowers (13%), chat (11.1%), pulses (6.5%), leather and leather items (1%), and oil seeds (11.5%) were Ethiopia’s top exports in 2020. The value of Ethiopia’s overall exports rose by 21% from the prior year.

Switzerland (18.8%), the Netherlands (8.1%), Saudi Arabia (5.8%), Somalia (5.8%), the United Arab Emirates (4.6%), and the United States (4.5%) were Ethiopia’s top five export destinations in 2020.

Africa accounted for 17.4% of Ethiopia’s exports, followed by the Americas (9.4%), Europe (41.3%), Asia (31%), and Africa (17.4%). To the United States, Ethiopia mainly exports coffee, leather, and leather goods.

Ethiopia imports goods from Asia (61.3%), Europe (22%), the Americas (7.6), which includes a sizable portion from the United States (3.4%), and other African nations (8.9%). China accounted for 22.8% of Ethiopia’s total imports of foreign goods. Sales of airplanes, building supplies, farm equipment, agricultural machinery, and technical services make up the majority of American exports to Ethiopia. The majority of all American exports to Ethiopia were made up of aircraft and aviation-related parts.

Due to its closeness and accessibility to dependable air shipping and air services, Dubai serves as an intermediary export platform for many United States businesses with offices in the United Arab Emirates (UAE) that conduct business in Ethiopia.

Government incentives

Ethiopia’s government offers incentives to investors in order to draw foreign direct investment, particularly for projects with an export focus. Due to Ethiopia’s participation in the Africa Continental Free Trade Agreement (AfCFTA), American businesses investing there are eligible for incentives like duty- and tariff-free trade.

Ethiopia lost its Africa Growth Opportunity Act (AGOA) status in 2021, along with Mali and Guinea, due to U.S. concerns over human rights abuses. Advocates for Ethiopia’s involvement in AGOA contend that initiatives like AGOA should boost and expand trade ties between the United States and Africa, particularly Ethiopia.

Through the policies provided by the African Trade Insurance Agency (ATI), which Ethiopia joined in 2016, political risk for foreign investors can be reduced. Specialized services from ATI handle trade and political concerns.

Additionally, ATI enables Ethiopian insurance firms to lessen commercial and political risks associated with losses brought on by nationalization, violation of concession agreements, import or export embargoes, inconvertibility or transfer risks, political violence, terrorism, confiscation, license revocation, and sabotage.

The following are the top five reasons why American companies should think about doing business in Ethiopia:

I- Ethiopia, the second-most populated nation in Africa and a regional hub with access to a large market, has almost 70% of its people under the age of 30, and up until 2019, it had one of the world’s fastest-growing economies. After the civil war, the nation is likely to resume its reform trajectory and grow its middle class and its purchasing power.

II- In comparison to other markets in Africa and the rest of the world, Ethiopia’s production costs—including those for land, labor, and energy—are cheap thanks to improved economic infrastructure and lucrative incentive programs.

III- Ethiopia is currently starting to liberalize its economy and privatize state-owned businesses and industry sectors, opening up previously off-limits to foreign companies.

IV- Ethiopians have a high regard for American goods and services because of their dependability and quality.

V- Prior to the interim U.S. freeze on aid for Ethiopia’s economic development in response to the civil war and humanitarian crises in the Tigray region, the U.S. Exim bank had a larger ability to lend money for transactions over $10 million.

Ethiopian project financing was also being provided by the Development Finance Corporation (DFC), which took over as OPIC’s replacement agency in October 2019. After the economic development support funding freeze is lifted, it is anticipated that these financial tools, among others, would be resumed.

EDITOR’S NOTE: This articles is produced based on the latest report of US International trade administration.