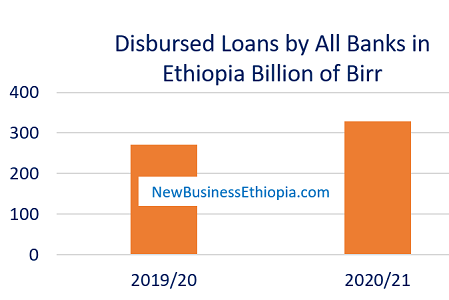

The amount of fresh loans disbursed by all Ethiopian banks in Ethiopia last year concluded June 30, 2021, has increased by 21 percent to 329.5 billion Birr.

All banks including Development Bank of Ethiopia (DBE), disbursed Birr 329.5 billion in fresh loans, depicting a 21.5 percent increase over last year, according to the latest annual report of the National Bank of Ethiopia (NBE).

Of the total new loans, about 63.2 percent was disbursed by private banks and 36.8 percent by public banks. The report stated that of the total fresh loan disbursed, international trade accounted for 20.1 percent, followed by industry (18.4 percent), domestic trade (15.2 percent), housing and construction (13.5 percent), agriculture (9.3 percent), mines, power and water resource (6.1 percent) and others (17.4 percent).

Deposit, borrowing, and loans

The total resources mobilized by the banking system in the form of deposit, borrowing and loan collection went up 51.5 percent and reached 505.2 billion Birr at the end of 2020/21.

This is partly bolstered by the NBE’s Legal Tender Protection Directive that restricts cash holding & cash withdrawals as well as the demonetization measure undertaken during the review fiscal year, according to NBE’s annual report.

“As result, the total deposit liabilities of the banking system rose to 1.4 trillion Birr, witnessing a 30.3 percent growth. Of the total deposits, saving deposits accounted for 60.3 percent, demand deposits 32.4 percent and time deposit 7.3 percent. Saving deposits showed 38.7 percent increment while demand and time deposits registered 23.4 percent and 3.9 percent growth,” it said.

Private VS state banks

The share of private banks in total deposit mobilization increased to 45.7 percent from 42.6 percent last year due to their opening of 749 new branches.

Meanwhile, the state bank, Commercial Band of Ethiopia (CBE), alone mobilized 54.3 percent of the total deposits due to its extensive branch network.

Raising funds through borrowing remained insignificant as most of the banks were sufficiently liquid due to increased deposit mobilization and collection of loans.

Their total outstanding borrowing reached 84.2 billion Birr compared to 80.4 billion Birr a year earlier due to higher borrowings by DBE, which is government policy bank.

Of the total borrowing, domestic sources accounted for 81.3 percent and foreign sources 18.7 percent. Net borrowing stood at 3.7 billion Birr of which 98.7 percent was from foreign and 1.3 percent from local sources, according to the report.

“Moreover, banks loan collection was Birr 186 billion in 2020/21, showing only 1.5 percent increment. Of which private banks collected 65.8 percent of the total loan disbursed,” the report stated.