A new report predicts double digit growth of Ethiopia’s banking industry. Ethiopia’s commercial banking sector will post a steady expansion over 2017, with both loan and deposit growth continuing on a strong upward trend, according to Business Monitor International (BMI) latest report on banking industry of Ethiopia.

Robust economic growth will continue to raise disposable incomes, boosting demand for credit and transaction accounts. Loans and deposits in the Ethiopian commercial banking sector will expand at a robust rate over the year ahead, continuing a long trend of double-digit growth. Still high economic growth, even as political risk remains elevated, and a sizable population will be the key driver of growth in the sector, according to the report.

“We forecast loan and deposits to grow by 27.0% and 28.0% respectively in 2017, keeping growth in line with the annual average of 28.1% and 25.8% over the past 10 years,” the report said.

Increasing Financial Inclusion Will Support Loans

The report further noted that loans will continue to post double-digit growth over a multi-quarter time horizon as the economy diversifies away from agriculture and disposable incomes rise. The country will still post strong economic growth and will see higher value added industries become increasingly important economic drivers over the years ahead.

“As a result, demand for credit from the private sector will rise as firms invest into new operations and expand existing ones. Already the proportion of new loans issued during the first quarter of 2016/17 were directed primarily towards trade and industry (see chart below) and we expect this will continue over 2017 which will boost loan growth,” it said.

The banking sector will also benefit from increasing integration of the sizable unbanked population. Ethiopia has the second largest population in Sub- Saharan Africa (SSA), estimated at 10 4 .3mn in 20 17, and with a rapidly expanding bank branch network we see loan growth remaining elevated. Indeed, the number of bank branches in the country have more than doubled from 1,28 9 in 20 11 to 3,18 7 in 20 16 and we expect this expansion will continue to boost new loans in the sector, according to BMI.

Robust Economic Growth Will Boost Deposits

While Ethiopia will see growth remain below historic levels, the country will s till pos t high growth levels compared to the wider SSA region, and this will

Support steady deposit growth over 20 17 and onwards. Economic growth will tick up from 5.4 % in 20 16 to 6 .0 % in 20 17 which is considerably higher than the SSA average of 1.8 % and 3.1% over the same period. Robust growth will enable a larger number of Ethiopians to take part in formal employment opportunities which would likely see them open up trans action accounts.

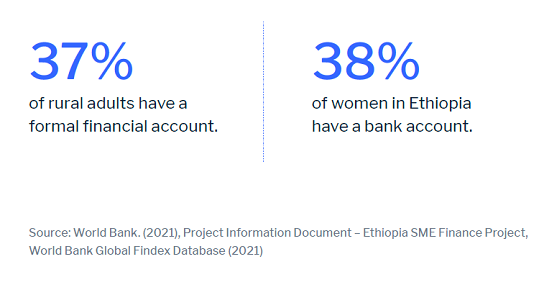

According to the World Bank, only 22.0 % of adults owned a bank account in 20 14 (latest available data) and a large population which will become gradually involved in formal employment over the years ahead will drive deposit growth.

The number of trans action accounts in Ethiopia has risen steadily in recently years and this will also receive a boos t from high urbanization rates .

Structural Characteristics of the Banking Sector

While Ethiopia’s banking sector will continue to be heavily regulated by the government, we expect private banks to rise in prominence over the next several years.

The public sector holds a disproportionate s hare of total capital with two public banks holding around 48 .9 % of total capital, compared to 16 private banks holding 51.1%. The country’s large population will see the banking sector g row at a steady pace as an increasing number of people enter formal banking channels, the report concludes.