Invest Africa, a Pan-African business and investment platform, aims to build constructive dialogue between policy makers and business leaders from the UK and Africa during the Forum.

James Duddridge MP, Minister for Africa, Emma Wade-Smith OBE, H.M. Trade Commissioner for Africa, and His Excellency Ken Ofori-Atta, Minister of Finance of the Republic of Ghana will feature in the programme.

The Forum will feature Dr Mo Ibrahim in conversation with CNBC Africa, discussing why supporting good governance is essential to driving growth and improving livelihoods across the continent. Speaking earlier this month, the Sudanese-British businessman called attention to the impact of Covid-19 on governance in Africa, highlighting job creation, improved education and healthcare and investment in economic development as essential conditions to building healthy democracies.

The Forum brings together speakers from Invest Africa’s membership, including Absa international; DHL; Casa Orascom; TTRO; Mischon de Reya; Tysers; Pernod Ricard and Afreximbank.

An explosion of trade with Africa

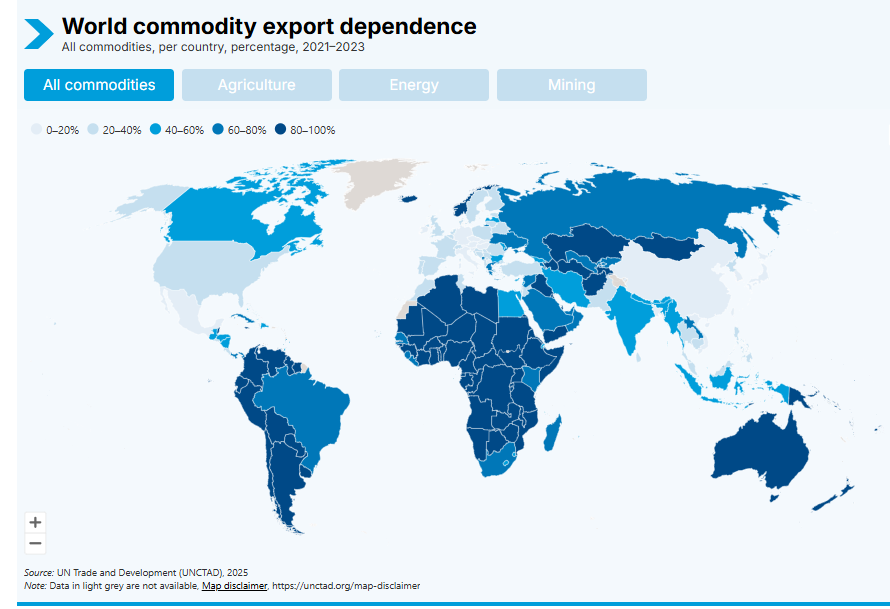

The Forum comes at an opportune time as trading under the AfCFTA commenced on the 1 January 2021, accelerating intra-African trade, and boosting Africa’s trading position in the global market.

This, combined with the UK’s departure from the European Union, has seen a rise in investment interest in Africa. The UK trade envoy to Egypt was recently quoted in the UK press, saying that Egypt ‘can be the “gateway” to an explosion of trade with Africa.’ Earlier this year, Helen Grant, Conservative MP and trade envoy to Nigeria claimed a trade deal with the country could be significant for the UK. Ms Grant boasted of Nigeria’s emerging economy and the impact it could have for British business in terms of financial services, agriculture, and tech.

In March 2021, the UK signed a trade partnership agreement with Ghana, that secures tariff-free trade and provides a platform for greater economic and cultural cooperation. In practical terms, it means that Ghanaian products such as bananas, tinned tuna and cocoa will benefit from tariff-free access to the United Kingdom.

In fact, as of June this year, the UK Government website lists over 15 trade agreements that the government has concluded in Africa. Where the agreement has not yet been ratified, provisional application or bridging mechanisms have been put in place to ensure continuity of trade. African countries with deals in place come from across the continent, including Egypt and Morocco in the North, Botswana and Lesotho in the South, Kenya in the East and Ghana in the West.

The private sector sees the potential too. Cheryl Buss, CEO of Absa International and a speaker at the Invest Africa Forum next week, was recently interviewed by a London financial newspaper and was optimistic about trade between the UK and Africa. She stated that “the UK is in a position to strengthen its relationships with Africa post-Brexit. This will lead to a more collaborative relationship based around trade and investment. Moreover, international trade opportunities into Africa are often facilitated via London, with the majority of European-African capital flows going through the City. “

Regulatory frameworks are fundamental to investors

Karen Taylor, CEO of Invest Africa and Lord Popat, UK Trade Envoy to the DRC and other panellists took part in an international trade webinar this month, hosted by the Congolese Chamber of Commerce in Great Britain. The event looked at regional integration and UK strategic investments in the DRC and the Republic of Angola.

Taylor echoed Dr Mo Ibrahim’s support of good governance during the event, making the following comments: “UK and international global investors are very much looking at ESG factors, critical to their decisions on which countries they are going to invest in and which companies they are going to invest in, so good governance is crucial for facilitating investment. Regulatory frameworks are also fundamental to the investors, and we need to make sure that they are in place to attract them in the first place so that they have that confidence and if it is not there it will hinder capital flow”.

Intra-African trade optimism is tempered by an acknowledgement of the challenges that investors face, ranging from logistical issues to regulatory frameworks. These challenges – and opportunities – will be discussed in the Invest Africa UK-Africa Forum.