The Executive Board of the International Monetary Fund (IMF) approved a two-year arrangement for Morocco under the Precautionary and Liquidity Line (PLL) for about $ 2.97 billion, or 240 percent of Morocco’s quota.

The access under the arrangement in the first year will be equivalent to SDR 1.25066 billion (about $1.73 billion or 140 percent of quota), according to the press statement from the IMF.

Despite a sharp pick up in global oil prices, the authorities have reduced fiscal and external vulnerabilities and implemented important reforms with the support of three consecutive 24-month PLL arrangements.

The new PLL arrangement will provide insurance against external shocks and support the authorities’ efforts to further strengthen the economy’s resilience and promote higher and more inclusive growth.

The authorities intend to treat the new arrangement as precautionary, as they have done under the previous three arrangements. Morocco’s first PLL arrangement for SDR 4.1 billion (about $6.2 billion at the time of approval) was approved on August 3.

The second PLL arrangement for SDR 3.2 billion (about $5 billion at the time of approval) was approved on July 28, 2014 and Morocco’s third arrangement for SDR 2.5 billion (about $3.5 billion at the time of approval) was approved on July 22, 2016.

The PLL was introduced in 2011 to meet more flexibly the liquidity needs of member countries with sound economic fundamentals and strong records of policy implementation but with some remaining vulnerabilities.

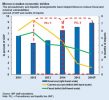

“Morocco has made significant strides in reducing domestic vulnerabilities in recent years. Growth remained robust in 2018 and is expected to accelerate gradually over the medium term, subject to improved external conditions and steadfast reform implementation,” said Mr. Mitsuhiro Furusawa, IMF Deputy Managing Director and Acting Chair of the Board.

External imbalances have declined substantially, fiscal consolidation has progressed, and the policy and institutional frameworks have been strengthened, including through the implementation of the recent Organic Budget Law, stronger financial sector oversight, a more flexible exchange rate regime, and an improved business environment, according to Mr. Furusawa.

“Nevertheless, the outlook remains subject external downside risks, including heightened geopolitical risks, slow growth in Morocco’s main trading partners, and global financial market volatility. In this context, a successor Precautionary and Liquidity Line (PLL) arrangement with the Fund will provide valuable insurance against external risks, and support the authorities’ policies aimed at further reducing fiscal and external vulnerabilities and promoting higher and more inclusive growth,” he said.

“Building on progress made under past PLL arrangements, further fiscal consolidation will help lower the public debt to GDP ratio over the medium term while securing priority investment and social spending. These efforts should be based on tax and civil service reforms, sound fiscal decentralization, strengthened oversight of state owned enterprises, and better targeting of social spending.”

Greater exchange rate flexibility will further enhance the economy’s capacity to absorb shocks and preserve competitiveness, according to the IMF.

“Adopting the central bank law and continuing to implement the 2015 Financial Sector Assessment Program recommendations will help further strengthen the financial sector policy framework. Finally, reforms of education, governance, the labor market, and continued improvement in the business environment will be essential to raise potential growth and reduce high unemployment levels, especially among the youth, and to increase female labor participation,” he said.