An International Monetary Fund (IMF) and the Government of Sierra Leone reached a new 38-month Extended Credit Facility (ECF) arrangement, with requested access of SDR 187 million (about US$253 million).

The ECF provides medium-term financial assistance to low-income countries (LICs) with protracted balance of payments problems. The ECF is one of the facilities under the Poverty Reduction and Growth Trust (PRGT).

The agreement is reached after the IMF mission, led by Mr. Christian Saborowski, visited Sierra Leone from September 4 to 13, 2024 and conducted the 2024 Article IV consultation and discussed with the Sierra Leonean authorities economic and financial policies that could be supported by the Fund. The staff-level agreement is subject to approval by the IMF’s Management and Executive Board.

“A new economic team took over last year and has since taken bold measures to tackle Sierra Leone’s macroeconomic imbalances including a severe cost-of-living crisis. The authorities reduced the domestic primary deficit by 2.8 percent of GDP in 2023 and are on track toward reducing it by another 2.1 percent this year. They also tightened monetary policy sharply by reducing year-on-year base money growth from a peak of 63.4 percent in June 2023 to 8.8 percent in June 2024, and raising the policy rate by 7.25 percentage points since end-2022,” said Mr. Christian Saborowski in a statement that followed the visit.

“The reform momentum has borne fruit. Inflation declined to 25 percent in August 2024, down from a peak of 55 percent in October 2023, and the sharp exchange rate depreciation experienced in 2022 and early 2023 was arrested. However, T-bill rates remain stubbornly high at over 40 percent, international reserves have fallen to less than two months of imports, and the electricity distribution company (EDSA) continues to make losses, resulting in significant fiscal pressures.”

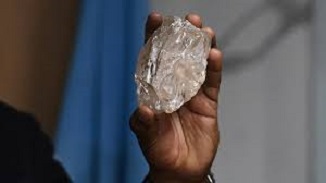

“Economic growth reached more than 5 percent in 2022 and 2023, buoyed by strong mining activity. Sierra Leone’s public debt continues to be assessed as sustainable but at high risk of distress, while its external position in 2023 is assessed as broadly in line with the level implied by fundamentals and desirable policies,” Saborowski added.

“The new ECF arrangement would aim to (i) restore stability by bolstering debt sustainability, addressing fiscal dominance, bringing down inflation, and rebuilding reserves; (ii) support inclusive growth through reforms—including to narrow gender gaps—and targeted social spending; and (iii) confront corruption, as well as strengthen governance, institutions, and the rule of law. These objectives would advance the poverty reduction and growth aspirations outlined in Sierra Leone’s Medium Term National Development Plan (MTNDP) 2024-30.”

Saborowski also stated that restoring stability in the Sierra Leonean economy will require a continued ambitious macroeconomic adjustment over the program period. Enhancing revenue mobilization, boosting spending efficiency, and managing fiscal risks will be critical to make room for priority spending on social policies and investment. Strengthening the monetary policy framework and maintaining appropriately tight monetary conditions will be important to safeguard internal and external stability.

“Making durable progress in fighting poverty and raising standards of living will require a commitment to reform, sustained political and social consensus, and well-targeted social policies. Promoting gender equality and increasing women’s economic participation are crucial to boosting Sierra Leone’s growth potential. So too are reforms to enhance the business environment by improving EDSA’s operational and technical efficiency, strengthening customs administration and transparency, and addressing climate change risks. Guided by the MTNDP 2024-30, steadfast progress in addressing these challenges will be critical.”