By Anwar Hussen Mohammed – The Government of Ethiopia has recently announced completing its preparations to introduce stock market by forming Ethiopian Capital Market Authority, which regulates both capital market and stock exchange. In this article we look into brief evolution of stock markets and its benefits in general.

But, first thing first, let’s define capital market and stock market:

A capital market is where companies go to raise financial capital (money) in general. On the other hand, a stock market / exchange is exclusively where investors trade stocks (shares of ownership in publicly traded corporations). Companies can raise money on the capital market by selling shares of stock in the company or by issuing bonds.

Benefits to economy

In general, an effectively functioning stock market allocates capital efficiently and provides sufficient funds to emerging, productive firms, which in turn breeds competition and innovation, ultimately fueling economic growth.

Evolution

The capital market boasts a rich history, evolving from simple lending practices to the complex financial systems we see today. expand more Here’s a glimpse into its fascinating journey:

Early Beginnings (Ancient Times):

• The seeds of capital markets were sown in Mesopotamia and ancient China with the emergence of moneylenders and rudimentary debt instruments.

• These early systems focused on loans to individuals and governments, laying the foundation for future financial structures.

The Rise of Debt Markets (Middle Ages):

• Fast forward to medieval Europe, particularly Italy during the Renaissance. This period saw the flourishing of merchant banking and the development of bond markets.

• These markets facilitated trade financing and government borrowing, marking a shift towards more sophisticated financial products.

The Birth of Equity Markets (17th Century):

• A pivotal moment arrived in the 17th century with the establishment of the Dutch East India Company, considered the first publicly traded company. expand more This innovation allowed individuals to invest in ventures through shares, marking the birth of equity markets. expand more

The Industrial Revolution and Beyond (18th & 19th Centuries):

• The Industrial Revolution fueled the demand for capital, leading to the creation of stock exchanges like the London Stock Exchange (1773) and the New York Stock Exchange (1817).

• These exchanges provided a centralized platform for trading stocks and bonds, fostering economic growth. expand more

The 20th Century and Regulation:

• The 20th century witnessed significant growth and innovation in capital markets. However, the Great Depression highlighted the need for regulations to prevent market crashes. Expand more.

• Institutions like the US Securities and Exchange Commission (SEC) were established to ensure fair and transparent markets. Expand more.

The Modern Era (20th Century Onwards):

• Technological advancements have revolutionized capital markets. expand more electronic trading platforms have replaced traditional floor trading, increasing efficiency and accessibility. expand more

• New financial instruments like derivatives and mutual funds have emerged, offering investors a wider range of investment options.

The Future of Capital Markets:

• The future of capital markets is likely to be shaped by continued technological advancements, such as blockchain and artificial intelligence.

• Globalization and the rise of emerging economies will also play a significant role, leading to a more interconnected and diverse financial landscape.

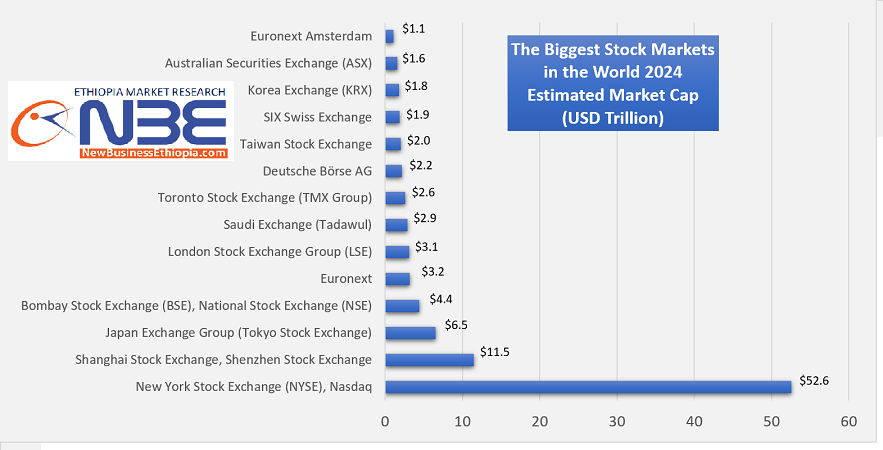

The top 10 stock markets in the world (2024)

The global stock market landscape continues to shift, with some surprising climbers in 2024. Here’s a breakdown of the top ten largest stock markets by market capitalization:

1. United States: The US remains the undisputed leader, boasting a combined market capitalization of a staggering $55.59 trillion. Major exchanges like the New York Stock Exchange (NYSE) and Nasdaq continue to attract leading international companies.

2. China: Despite some recent fluctuations, China holds the second spot with a market capitalization around $11.5 trillion. Shanghai Stock Exchange and Shenzhen Stock Exchange are key players in this market.

3. Japan: Japan comes in at number three with a market capitalization of approximately $6.5 trillion. The Tokyo Stock Exchange (JPX) is a major hub for established and tech-oriented companies.

4. India: India’s stock market has seen a remarkable rise in 2024, reaching a market capitalization of over $4.4 trillion and securing a place in the top five. The Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are leading the charge.

5. Hong Kong: Hong Kong’s market capitalization has experienced some decline in recent years, but it still holds a strong position at around $3.8 trillion. The Hong Kong Stock Exchange (HKEX) remains a significant player in Asia.

6. France: The French market capitalization sits at approximately $3.2 trillion. Euronext, a pan-European exchange group, plays a major role in the French market.

7. United Kingdom: The UK market capitalization is around $3.1 trillion. The London Stock Exchange (LSE) is a prominent exchange for international companies.

8. Canada: Canada’s market capitalization is close to $2.6 trillion. The Toronto Stock Exchange (TSX) is a key exchange for resources and financial services companies.

9. Saudi Arabia: Saudi Arabia is a new entrant in the top ten, with a market capitalization exceeding $2.9 trillion. The Tadawul Stock Exchange is a rising force in the Middle East.

10. Other Markets: Several other markets hold significant weight, including Germany, Taiwan, and Switzerland.

When we come back to the case of Ethiopia, Ethiopia securities Exchange (ESX) is expected to start operation in the coming months. Profitable state-owned enterprises such as Ethio Telecom, Commercial Bank of Ethiopia, Ethiopian Shipping and logistics services enterprise, and Ethiopian Airlines, among others, are expected to be listed on ESX. In addition, private banks, insurances and the like are also expected to be listed on ESX.