Professional investors forecast dramatic expansion in the levels of investment in Africa by pension funds and large corporates over the next five years.

This is because major funds increasingly regard the continent as an attractive area to invest, new global research for blockchain-based mobile network operator World Mobile shows. The study with professional investors responsible for around $700 billion assets under management by independent research company PureProfile found one in four are forecasting dramatic growth in institutional investment in the continent over the next five years with 46% expecting some growth. Just 12% expect a drop in investment.

The predicted growth in investment is driven by the attraction of the stable parts of Africa as a home for foreign direct investment with 80% of investors questioned rating the continent as attractive with 33% regarding it as very attractive for investment, the research among investors in the US, Germany, the UK, Hong Kong, India, Japan, Nigeria, and Switzerland found.

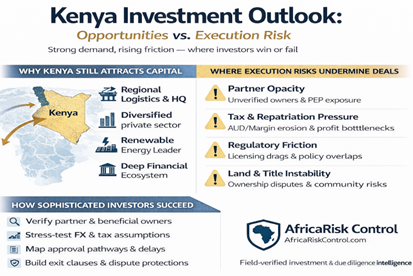

World Mobile is already active in Africa and is launching its unique hybrid mobile network supported by low altitude platform balloons in Zanzibar which it plans to roll-out throughout the continent. It is already in discussions with government officials in Tanzania and Kenya, as well as other territories underserviced by traditional mobile operators.

The research shows poor connectivity is the biggest barrier for organizations planning investment in Africa. The study ranked poor connectivity, which can mean no connectivity in some countries, above worries about a lack of infrastructure, regional conflicts, and corruption as constraints on investors.

World Mobile’s balloons will be the first to officially launch in Africa for commercial use, providing a more cost-effective way to provide digital connection to people and is the first step in its mission to help bring nearly four billion people online before 2030 in line with the UN and World Bank’s SDGs.

The study shows investors believe Africa has massive potential – the key attraction for investors identified by the research is the large population offering a huge market for telecoms and banking. Natural resources and economic reforms across the continent were also rated as key attractions.

Micky Watkins, CEO of World Mobile said: “Foreign direct investment around the world has been badly hit by the COVID-19 pandemic and Africa has suffered along with other regions.

“The case for investing in the continent remains very strong and professional investors recognize that, as shown by our research which also forecasts strong growth over the next five years.

“Beyond the investment case there is a bigger prize in helping to unleash the potential of the continent and raise living standards. That requires connectivity and we want to help create a world where everyone can access affordable connectivity, a world where economic freedom is a truth and a world where people are able to jump on the opportunities that internet creates.”

The World Mobile approach is more sustainable, in environmental, social and governance terms. Environmental impacts are mitigated using solar-powered nodes, second-life batteries, and energy-efficient technology.

World Mobile creates a positive societal impact through the application its circular economy model – a “sharing economy” where locals share in the ownership and rewards of the network. Governance is maintained by the secure underlying blockchain technology, which means that user data privacy is guaranteed and not commercially applied as it is by other mobile operators.

PureProfile is a people-centred global data, insights and media organization providing online research and digital advertising services for agencies, marketers, researchers and publishers. Founded in 2000 and based in Surry Hills, Australia, we operate in North America, Europe and APAC and have delivered solutions for over 700 clients.