Ethiopia, Tanzania, Kenya and Uganda offer investors a reward score above the African continent’s average, according to the 2018 Africa Risk-Reward Index from Control Risks and Oxford Economics.

Ethiopia and Tanzania lead the list of the top rewarding economies for the second time, with Kenya following in fourth position after Côte d’Ivoire. Strong improvements on both the reward and the risk side make Uganda one of the strongest performers of the June 2018 edition of the Africa Risk-Reward Index.

Daniel Heal, Senior Partner for East Africa at Control Risks, comments:

“Ethiopia with its impressive reward score of 7.94 out of 10 offers opportunities for investors specifically in the agriculture and manufacturing sectors which continue to demonstrate high levels of growth. The government’s new privatisation push in the energy, telecoms and logistics sectors also offer new and exciting opportunities for investors. However, its risk score of 5.79 is also above the continents average of 5.54 due to the ongoing political transition under new Prime Minister Abiy Ahmed, who will need to delicately balance the interests of the political elite with opposition demands for the opening of political space.

“With great economic potential across sectors from energy to agro-processing, Tanzania remains an interesting but volatile target for potential investors. However, the country’s continuously high reward score is overshadowed by a high risk score of 5.72. President John Magufuli’s rising autocracy and several legislative changes – giving the administration permanent sovereignty over mineral wealth as well as the ability to renegotiate exploration and production agreements, increase its shareholding in mining companies and increase mining royalties – raise concerns within the international investor community.

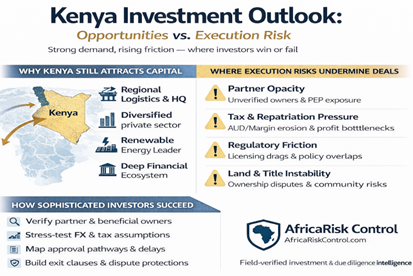

“After Kenya‘s protracted 2017 election period and consequently reduced investment levels, 2018 is an exciting year for investment opportunities in Kenya. Kenya’s reward score remains one of the highest in sub-Saharan Africa and the ruling Jubilee Party of Kenya continues its pro-business policies. However, improving relations between the government and the opposition will be instrumental in ensuring that political tensions do not undermine economic growth, and more prudent fiscal and macroeconomic policies are needed to maintain positive economic prospects.

“Uganda ranks among the top economies in the 2018 Africa Risk-Reward Index when it comes to positively changing its scores. Relative political stability under President Yoweri Museveni means that priority national projects such as oil production or infrastructure projects face few policy or bureaucratic delays. While the prospects for economic growth have improved following the end of a regional drought and the election period in neighbouring Kenya, concerns over a deteriorating security environment mitigate the otherwise improved risk score.”

Further findings of the report:

- Angola’s leadership change has not yet improved its reward score, but its risk score has gone down: Angola’s new president, João Lourenço, has acted with remarkable speed and decisiveness to consolidate his authority. Efforts to dismantle his predecessor’s networks have provided new opportunities for foreign investment in sectors previously dominated by companies linked to the former president and his family. Combined with an improved regulatory environment, investors can seek opportunities predominantly in the oil and gas, diamond, and telecommunications sectors.

Reward score: 3.65 / risk score: 6.55 - South Africa – slightly increased reward score and reduced risk score as political uncertainty eases: Investor confidence has increased since Cyril Ramaphosa assumed the presidency in February 2018. The implementation of policies – intended to consolidate fiscal expenditure and tackle corruption in public institutions and state-owned enterprises – increases opportunities for doing business in South Africa. But deeply entrenched patronage networks and electoral pressure ahead of the 2019 general elections will contribute to a slow recovery of South Africa. Reward score: 4.78 / risk score: 4.74

-

Côte d’Ivoire, with a forecasted real GDP growth rate of 7% in 2018, continues its impressive economic recovery, but great challenges remain: With reforms to the business environment and efforts to bring foreign investors back after the 2010-2011 crisis, Côte d’Ivoire has achieved amongst the highest growth rates in the world in recent years, and sectors such as construction, telecommunications, banking and retail have seen considerable growth. However, severe obstacles to a full recovery persist, including political interference and corruption, socioeconomic discontent, shortcomings in security-sector reform, and growing competition ahead of the potentially volatile 2020 presidential poll.

Reward score: 6.51 / risk score: 6.24.

- Senegal – growing investment and a reduced risk score presage continuous growth: Under the Emerging Senegal Plan, growth has increased steadily over the last three years, reaching close to 6.4% in 2017. Growing exports, a more diversified economy and increased interest from large international investors as a result of the promising offshore oil and gas discoveries make Senegal one of the poster children in sub-Saharan Africa. The reduction in its risk score is one of the most positive changes in the 2018 Africa Risk-Reward Index. Reward score: 5.76 / risk score: 4.56

Morocco – economic reforms improve the country’s resilience and make its exports more competitive, but social discontent remains a challenge: With one of the lowest risk scores on the 2018 Africa Risk-Reward Index and a relatively stable reward score, Morocco’s economic reforms prove to be a success. Medium-term growth will be enhanced by continued reforms to facilitate foreign investment, access to finance, quality of education and the business environment, as these represent the primary constraints to competitiveness and doing business. However, social-economic unrest over poor living conditions persists particularly in interior regions. Reward score: 5.77 / risk score: 4.10