The Ethiopian Revenue and Customs Authority set to increase government revenue for the fiscal year 2009/10 (July 8, 2010 – July 7, 2011) by 52 percent from last year.

Director General of the Authority, Melaku Fenta told media this morning (August 12, 2010) that the total annual government this fiscal year, which started July 7, 2010, will reach 54.1 billion birr (around 4 billion USD at prevailing exchange rate).

“We will attain our target by expanding our successful previous year achievements,” Melaku said. “We will also continue including businesses to the existing tax system of the country as well as identify various tax items and collect money,” he said.

Out of the total targeted income, 47 percent is expected to be collected from customs while the remaining will be generated from domestic taxes, according to the director general.

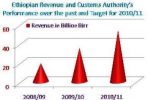

Lat year the authority collected a total of 35.7 billion birr (around 2.6 billion USD at prevailing exchange rate), which is 1.1 billion birr more than its target for the fiscal year 2009/10 (July 8, 2009 – July 7, 2010).

Over the past few yeas, Ethiopian government revenue has been increasing rapidly. Three years ago, for the budget year ended July 7, 2009, the authority collected only a total of 19.5 billion birr.

The authority also indicated that it will continue modernizing the tax system of the country in order to increase efficiency of its service and collect more taxes.

“We expect that tax revenue to GDP ratio of the country will reach at the level of the developing country after five years. Our main objective is position our country at the stage of fully financing all its development activities from local income,” Melaku noted.

The average tax revenue/GDP ratio for Ethiopia is 11 percent. Meanwhile, for sub-Saharan Africa, middle income countries and high income economies, the ration is 16 percent, 25 percent and 40 percent, respectively.