Hit by severe forex shortage once again, the government of Ethiopia has launched a study that will allow to liberalize it financial system.

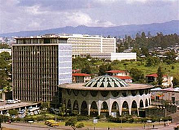

Involving experts from the World Bank, the study launched by the government aims to address the chronic problems in the financial sector of Ethiopia by opening the sector for foreign banks, introducing capital market, among others, according to Yinager Desse, the new Governor of the National Bank of Ethiopia (NBE).

Presenting the past eight months’ performance report of NBE, Dr. Yinager told MPs on Friday that the hard currency Ethiopia is currently generating is only enable the nation to import fuel and medicine. Import earnings of the country over the past eight months has declined by 9.4 percent as compared to last year same period, according to Yinager who indicated that 1.64 billion U.S. dollar is obtained from import over the last eight months.

The governor also indicated that during the same period the country has earned 3.82 billion U.S. dollar from remittance. Meanwhile during the same period, the country has imported goods worth 10.5 billion U.S. dollar. Remittance income of Ethiopia has increased by 1.3 percent compared to same time last year. Of the total the country has spent 1.73 billion U.S. dollar on fuel import.

Even though there is no enough forex to be provided for importers as per their interest, at the moment the country’s forex reserve can cover 2.6 months of basic import of the country, according to Governor Yinager.

Ethiopia has signaled its readiness to reform its financial sector by opening its doors for foreign banks when its parliament approved the African Continental Free Trade Area) agreement. Among others, the parties of the AfCFTA are expected to liberalize their financial sector, among others.

At times in Ethiopia it takes several months for the private sector to open letter of credit and secure forex from the government to import goods.