The African Development Bank approved a $100- million facility to finance Export Trading Group (ETG’s) soft commodity value chain operations in sub-Saharan Africa.

This Soft Commodity Finance Facility (SCFF) is one of the core Trade Finance instruments in the Bank, innovatively structured to provide pre- and post-shipment finance along various stages of ETG’s commodity value chain operations in the 17 countries expected to benefit from the initiative. This intervention will help local farmers and soft commodity suppliers grow their revenues and produce quality crops for export.

Specifically, the facility will be used to finance the procurement of identified agricultural commodities from over 600,000 farmers. Upon purchase of the soft commodities, the SCFF will provide working capital to ETG. That will enable the company to engage in value addition/processing of the soft commodities such as cashew nuts prior to export. It also provides funding to procure farm inputs (mainly fertilizer components for blending) to be supplied to farmers so as to ensure consistency and quality of the commodities being supplied to ETG

This Trade Finance intervention along the agricultural value chain will enable the Bank to reach many small-scale farmers indirectly through ETG, a pan African aggregator that has deep knowledge of the market in which it has accumulated a 50-year track record; understands the agricultural sector operational risks and is able to mitigate and manage them.

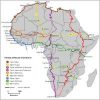

Originally established in Kenya in 1967, ETG’s operations connect commodities sourced at the farm gate to local economies, from the local economies to the broader marketplace and emerging markets to each other and the world. ETG’s principal activities include; farm inputs and farm implements, processing of agricultural commodities and distribution. The Group employs more than 6000 people and has investments in bioenergy, farming, forestry and logistics and its operations are present in 26 African countries.

Thus, as one of the largest commodity aggregators on the continent, ETG plays a significant role in the promotion of agribusiness in countries where agriculture is on average the biggest employer, providing in excess of 70% of total employment and 77% of all women jobs. The Group’s operations are well aligned with four of the Bank’s High 5 development priorities, namely (Feed Africa, Industrialize Africa, Integrate Africa, and Improve the quality of life for the people of Africa.

Through the implementation of innovative programmes such as this SCFF, the AfDB seeks to promote private sector development in line with its Ten-Year Strategy (2013-2022) and the Trade Finance Program, which aim to promote exports through support to agriculture and SMEs.

The initiative is also perfectly aligned with the Bank’s Financial Sector Development Policy and Strategy (2014–2019) whose main priorities are to broaden and deepen Africa’s financial systems by putting finance at the center of Africa’s productive capacity.

By channeling financial resources into agricultural value chains, the Bank is scaling up its interventions aimed at making Africa a net food exporter, self-sufficient in key commodities and operate commercially viable agribusinesses which is a core feature of the Feed Africa Strategy for Agricultural Transformation in Africa 2016-2025.