In the face of looming global recession, emerging market faces multiple risks ranging from high external borrowing costs to stubbornly high inflation, and volatile commodity markets, says a new report released on Tuesday by the International Monetary Fund (IMF).

Emerging markets face a multitude of risks stemming from high external borrowing costs, stubbornly high inflation, volatile commodity markets, heightened uncertainty about the global economic outlook, and pressures from policy tightening in advanced economies.

“Pressures are particularly acute in frontier markets, where challenges are driven by a combination of tightening financial conditions, deteriorating fundamentals, and high exposure to commodity price volatility. Interest expenses on government debt have continued to rise, increasing immediate liquidity pressures. In an environment of poor fundamentals and lack of investor risk appetite, defaults may follow.”

However, the IMF report said “investors have continued to differentiate across emerging market economies so far, and many of the largest emerging markets seem to be more resilient to external vulnerabilities”.

“Nonresident portfolio flows remain weak despite some signs of stabilization after sizable outflows in the first half of the year,” the IMF latest Global Financial Stability Report released on Tuesday. The report focused on the risks to global financial stability in the current macro-financial environment—an environment that is new to many policymakers and market participants.

The global economic outlook has deteriorated materially since the April 2022 Global Financial Stability Report (GFSR). A number of downside risks have crystallized, including higher than-anticipated inflationary pressures, a worse-than-expected slowdown in China on the back of COVID-19 outbreaks and lockdowns, and additional spillovers from Russia’s invasion of Ukraine.

The report noted that emerging market assets already suffered large losses, and sovereign spreads of high-yield emerging markets rose nearly to levels last seen in March 2020,

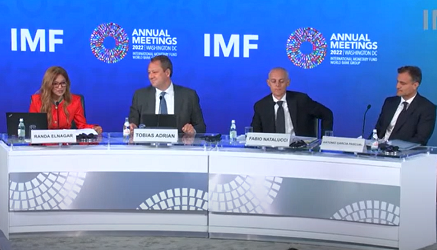

“Crypto markets also experienced extreme volatility leading to the collapse of some of the riskiest segments and the unwinding of some crypto funds. In the middle of the year, as recession fears grew, risk assets rallied on hopes that the monetary policy normalization cycle would end sooner than previously anticipated,” stated the IMF’s Global Financial Stability Report released on October 11, 2022 on the sidelines of the annual IMF-World bank Meetings in Washington.

“These moves, however, have been unwound and risk assets have experienced further losses, as major central banks have strongly reaffirmed their resolve to fight inflation and meet their price stability mandates. Disagreement among investors around the most likely inflation outcomes appears to have become more notable.

In the euro area, there are significant odds of both low- and high-inflation outcomes, likely reflecting heightened concerns about a slowdown in aggregate growth, according to the report which stressed that global financial stability risks have increased amid a series of cascading shocks.

“There is a risk, however, that a rapid, disorderly repricing of risk in coming months could interact with, and be amplified by, preexisting vulnerabilities and poor market liquidity.”

“Market liquidity metrics have worsened across asset classes, including in markets that are generally highly liquid and among standardized and exchange-traded products. US Treasury bid-ask spreads have widened significantly, market depth has declined sharply, and liquidity premiums have increased,” the report said.

European financial markets have shown strains since the April 2022 Global Financial Stability Report (GFSR). Asset prices have sold off on the back of growing recession fears amid natural gas shortages and the reemergence of fragmentation risks in the euro area.

However, spreads of southern European government bond yield over German yields tightened after the European Central Bank’s announcement of a new tool to fight fragmentation in the euro area, the Transmission Protection Instrument.

In the UK, investor concerns about the fiscal and inflation outlook following the announcement of large debt-financed tax cuts and fiscal measures to deal with high energy prices weighed heavily on market sentiment.

The British pound depreciated abruptly, and sovereign bond prices dropped sharply. To prevent dysfunction in the gilt market from posing a material risk to UK financial stability, the Bank of England, in line with its financial stability mandate, announced on September 28 temporary and targeted purchases of long dated UK government bonds.

Central banks in emerging and frontier markets have also continued to tighten monetary policy. But regional differences remain stark, with some countries hiking policy rates earlier and more aggressively in response to inflationary pressures.

Conditions in local currency bond markets have worsened materially, reflecting concerns about the macroeconomic outlook and rising debt levels. Sovereign bond term premiums have increased sharply, especially for central and eastern Europe.

The IMF report recommended that central banks must act resolutely to bring inflation back to target, keeping inflationary pressures from becoming entrenched and avoiding de-anchoring of inflation expectations that would damage credibility.

“The high uncertainty clouding the outlook hampers the ability of policymakers to provide explicit and precise guidance about the future path of monetary policy. But clear communication about their policy reaction functions, their unwavering commitment to achieve their mandated objectives, and the need to further normalize policy is crucial to preserve credibility and avoid unwarranted market volatility,” the report said.